This is how Financial Accounting Information is used

This is how Financial Accounting Information is used by stakeholders – Here are users of financial accounting information. In fact, a variety of stakeholders use financial accounting information for different purposes. This is how Financial Accounting Information is used.

As a matter of fact, existing entrepreneurs and potential entrepreneurs use financial information for various reasons. Explained in this post are users of accounting information and their needs. These are also classified into internal and external users of accounting information.

Contents

- 1 Our Focus: This is how Financial Accounting Information is used

- 1.1 Users of Financial Accounting Information

- 1.2 This is how Financial Accounting Information is used

- 1.3 This is how Financial Accounting Information is used

- 1.4 Internal and External users of Financial Accounting information:

- 1.5 This is how Financial Accounting Information is used

- 1.6 Characteristics of Financial Accounting Information:

- 1.7 Related Posts:

- 1.8 This is how Financial Accounting Information is used

- 1.9 Let us know your business needs:

- 1.10 Summing Up on how Financial Accounting Information is used

- 1.11 Share this:

- 1.12 Like this:

Our Focus: This is how Financial Accounting Information is used

Therefore our focus here is to highlight the users of financial accounting information. By this, we intend to educate our young entrepreneurs on the usage of financial accounting information. For this, we have listed below other related topics for your complete information understanding. Just click to read.

- How non-accountant CEOs should understand Accounting Equation,

- How non-accountant entrepreneurs understand Accounting Debit and Credit Rules,

- Free Accounting Basics for Non-Accountant CEOs:

- How Entrepreneurs See Accounting Circle and

- Accounting Definition – Accounting basics

- Users of Financial Accounting Information

- Basic accounting Concepts and Principles

- The Rules of Debit and Credit

- Double Entry Bookkeeping System

- Accounting Cycle, i.e., analyzing, recording, classifying, summarizing and interpreting

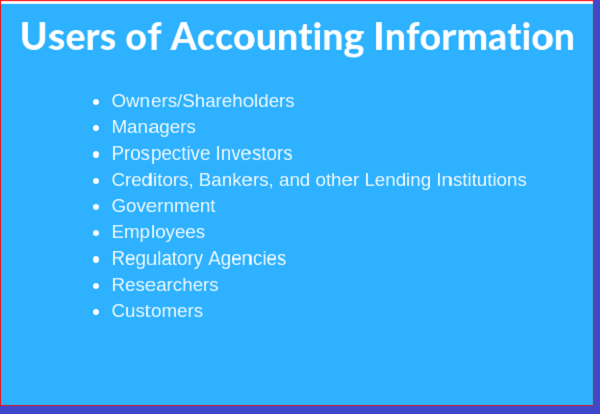

Users of Financial Accounting Information

Check out the following! Are you one of them? They are Users of Financial Accounting Information

This is how Financial Accounting Information is used – Can we answer this question? How do business owners use financial information? Business Owners use the financial information to assess the financial performance of their businesses. This enables them to make decisions such as whether or not to purchase additional stock, sell existing stock, or maintain the current level of stock ownership. Or whether or not to continue or discontinue part of the business. Again, are make-or-buy decisions. Acquire or rent/lease certain equipment in the production of goods.

Managers:

Managers use accounting information to plan and evaluate the company’s performance and to manage risks. Again, managers set a realistic budget and identify the need for funding using the financial accounting information. Therefore, Financial Information can be used by managers to track performance, budgets, and other metrics, and as tools to make decisions, motivate teams, and maintain a big-picture mindset. This is how Financial Accounting Information is used

Prospective Investors:

Now, how do prospective investors use accounting information? As a matter of fact, prospective investors with strong accounting backgrounds use financial reports to identify key risk areas. These can point to potential losses in asset values. In addition, investors use financial information to calculate financial ratios. Financial ratios assist in estimating a company’s liquidity and default risks.

Creditors, Bankers, and other Lending Institutions:

Furthermore, creditors such as banks, suppliers, and others use financial information to outline asset values. They also use it for short- and long-term debt assessment. In fact, lenders get a better sense of a company’s creditworthiness through financial accounting information. Therefore, Creditors use accounting information to decide whether to lend money to a business and to evaluate a company’s ability to make the loan payments.

This is how Financial Accounting Information is used

Government:

Now, how does the government use accounting information? As a matter of fact, Federal and State Governments require tax returns and other documents often prepared by accountants. So, various Government agencies and departments like the Registrar of Companies, Company Law Board and Tax Authorities, etc. use accounting information. These are required for tax assessment. It is also used in evaluating how well various businesses are operating under law-related requirements.

Employees: This is how Financial Accounting Information is used

Employees are part of the internal users of financial information. These are people within a business organization who use financial information. These include owners, managers, and employees.

As a matter of fact, employees use accounting information to find out the financial health of an organization. They also use it to assess the amount of sales and profitability of businesses to determine their job security. They so determine the possibility of future remuneration, retirement benefits, and employment opportunities.

Check out for financial accounting statements here

Regulatory Agencies:

The first class of regulatory bodies are those concerned with regulation accounting information preparations and presentations. Thus, such Regulations and regulatory agencies serve as external control mechanisms for financial accounting statements. In fact, they ensure that the financial statements provide a fair view of the company’s operating performance. And that the financial information is free of any unethical practice and suitable for all stakeholders’ needs.

The second class is those who regulate the organizations producing the financial accounting information. For instance, the central bank watches the financial information or statements from the various banks. Such regulatory agencies are the users of accounting information and financial statements.

So, they use the information for various reasons. For instance, they use the information to verify the state levies and taxes paid. This information also helps them to understand the industry trends, statistics, and measures of GDP, etc. But This is how Financial Accounting Information is used

Researchers:

Researchers use financial accounting information for a variety of reasons. Even in the academic world, several reasons are there to look into financial accounting information. Investor researchers and internal control researchers and analysts use the financial statement information for forecasting profitability for two objectives: (i) to generate improved forecasts of profitability and accurate estimates of firm value; and (ii) to identify market inefficiencies with respect to financial statement information. Again, This is how Financial Accounting Information is used.

Furthermore, as stated above, it helps researchers to understand the industry trends, statistics, and measures of GDP, etc. Financial accounting information is everything to financial and economics researchers.

This is how Financial Accounting Information is used

Customers/Clients:

Customers can be any of the above-listed users already. So, their needs vary. Therefore, Banks or lending institutions may use accounting information to guide decisions such as whether to lend or how much to lend a business. Investors will also use accounting information to guide investment decisions.

But Customers have an interest in accounting information for quite a different thing altogether. In fact, they want to assess the financial position of a business for business continuity. This is very important to them especially when they have a long-term business involvement with the entity. Therefore, the financial accounting information will enable them to assess how they can maintain a steady source of business. They’re interested in the perpetuity of the organization.

Internal and External users of Financial Accounting information:

Just as we hinted in our first paragraph, the above-enumerated users can still be classified into Internal and External users. So, some of the ways internal users employ accounting information include the following:

- Assessing how management discharged its responsibility toward protecting and managing the company’s resources

- Shaping decisions as to when to borrow invest or lend company resources

- Shaping decisions as to how to go about expansion or downsizing programs.

For external users, some of the uses for financial accounting information include;

- Stockholders have the right to know how a company is managing its resources

- Federal and State Governments require tax returns and other documents. These re documents prepared by accountants

- Banks or lending institutions may use accounting information to guide decisions. These could be as to whether to lend or how much to lend a business

- Investors will also use accounting information to guide investment decisions

This is how Financial Accounting Information is used

Characteristics of Financial Accounting Information:

With reference to our highlights in the first paragraph, financial accounting information have qualities. These are their characteristics which are very relevant for users of financial accounting information. This is because if any information is not material, it’s a waste of time checking it. So, check out these characteristics.

- Relevance – information to be used must be relevant for the usage.

- Reliability – Information must be verifiable. This is because non-verifiable information are not reliable

- Comparability – This is important for trend and industry analysis.

- Understandability – Information to be used must be understandable otherwise it can not be verifiable..

- Timeliness – Information must also be timely. With the rate of information in recent times, two-year-old figures may not be reliable again.

- Cost-benefit – This is an issue of materiality. Except for other reasons like legalism on issues, it may be wasteful to spend N200,000.00 to search or investigate an item worth N15,000.00

- Verifiability – As hinted above, verifiability means that such figures are factual and reliable.

- Neutrality – This defines the unbiases in the production of financial accounting information. It means that none of the information users is favored in the values and information presented.

- Completeness – finally, is completeness. In actual fact, uncompleted information lacks all the characteristics listed above.

- This is how Financial Accounting Information is used

Related Posts:

These are part of our series of researches on this subject matter. This series centres on the usefulness of accounting information by non-accountant CEOs and entrepreneurs. Can you click to read them to support your knowledge of how Financial Accounting Information is used.

- How non-accountant CEOs should understand Accounting Equation,

- How non-accountant entrepreneurs understand Accounting Debit and Credit Rules,

- Free Accounting Basics for Non-Accountant CEOs:

- How entrepreneurs see Accounting Circle and

- Accounting Definition – Accounting basics

- Users of Financial Accounting Information

- Basic accounting Concepts and Principles

- The Rules of Debit and Credit

- Double Entry Bookkeeping System

- Accounting Cycle, i.e., analyzing, recording, classifying, summarizing and interpreting

This is how Financial Accounting Information is used

Let us know your business needs:

Yes! Let us know your business needs, we may help out. So, check out the list below, you may have what we can help you fix in your business.

- With A bankable Business Plan for all scope of operation

- Train and apply for CBN/BOI/ NIRSAL MFB AGSMEIS and other loan facilities

- Register your business appropriately with C.A.C.

- Make incorporation changes for you @ C.A.C. – change of MEMART, Director, Shareholding etc.

- Render annual returns for you @ C.A.C. and obtain other certifications/reports for you

- Apply and obtain SCUML certificate for your banking purposes

- Apply and obtain contract bidding compliance certificates for you – PENCOM, NSITF, ITF, BPP IRR, Tax Clearance certificate

- Auditing Services and Tax management services

- Apply and obtain regulatory certificates – Import/Export licenses, NCC licenses, NAFDAC certificates etc.

- And other consultancy services

If you want to be come a professional, click here

Summing Up on how Financial Accounting Information is used

On how Financial Accounting Information is used, we’ve above all you need to know for now. If you didn’t quit understand, refresh and start off again. Or bookmark it to come back to it latter. Now, follow us on our face-book pages.

Again, we would like you to help share this to reach your friends. Sharing is made simple here by your clicking on any of the social media buttons on this page. Then, contact us at +234 9053130518/08034347851 or emailing via [email protected]. Get inspired here

And, to get more information on this website, use our search button on this page. Just type in whatever you want, and this site will give you that. Get professional tips here Thanks for reading through This is how Financial Accounting Information is used