Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles – This all about Non-Accountant Entrepreneurs. It’s actually how the non-accountant entrepreneur can apply Basic Accounting Concepts and Principles. Read more about Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Again, this is part of our mentorship program for young entrepreneurs who do not have knowledge of accounting. Our experience has shown that most of this group of entrepreneurs don’t understand the usage of accounting principles in their business. And that is a big industrial challenge.

Therefore, we have decided to put in place a series of mentorship program articles. So, we will be covering basic accounting issues starting by defining Accounting, which we have already done.

Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles – In fact, our first phase of this program will cover the following;

- Accounting Definition – Accounting basics

- Users of Financial Accounting Information

- Basic accounting Concepts and Principles

- Accounting Equation

- The Rules of Debit and Credit

- Double Entry Bookkeeping System

- Accounting Cycle, i.e., analyzing, recording, classifying, summarizing and interpreting

- You are expected to cross reference these topics by clicking on them to read accordingly.

Contents

- 1 Summaries of our last article on Accounting for Non-Accountant businessmen and women

- 1.1 The Accounting Principles/Concepts:

- 1.2 Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

- 1.3 Materiality:

- 1.4 Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

- 1.5 Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

- 1.6 Read Also: Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

- 1.7 Summing Up on Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

- 1.8 Share this:

- 1.9 Like this:

Summaries of our last article on Accounting for Non-Accountant businessmen and women

Here are the summary of our last article on this subject matter. The accounting basics on accounting categories are summarized below:

- Assets. – Items of financial value that the business controls (“owns”) for the purpose of producing income for the owners.

- Liabilities. – Monies that the business owes to non-owners.

- Owners Equity. – The theoretical value of the business that would be distributed to the owners after the assets were sold and the liabilities paid.

- Revenue. – Payments made to the business by customers for the goods and/or services provided by the business.

- Expenses. – Costs incurred by the business in providing the goods and/or services purchased by the customers.

- Read more about Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

The Accounting Principles/Concepts:

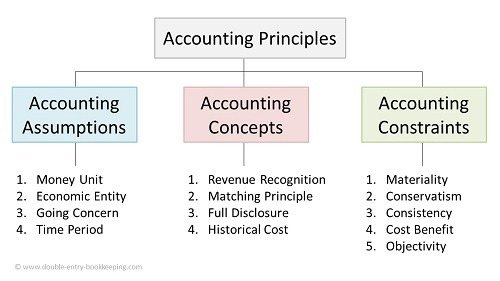

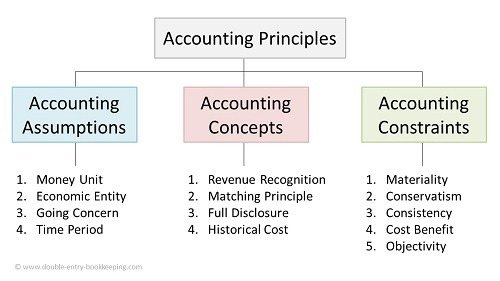

These are the Basic Accounting Concepts Every Small-Business Owner Should Know. We implore you to please take your time to read through. Accounting principles are the rules and guidelines that companies must follow when reporting their financial information. The Financial Accounting Standards Board (FASB) issues these generally accepted accounting principles (GAAP)

As a matter of fact, we found out that understanding these principles and concepts will help you understand what that small boy or small girl accountant/cashier is doing in your office. So, please, read on. These are free coaching. As professionals, we spend a lot of resources to acquire knowledge, but here we give them out for free. This is Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles.

Accruals/Revenue Recognition Principle.

This principle tells us when to recognize the revenues we generate. In fact, this is the period of time when revenues are recognized in your accounting statements, the P & L. Here, there are two bases. The first one is the accrual basis. That is to say, when the revenue accrues to your business, as when the business is carried out, whether payment is made immediately or later. On the other hand, the cash basis recognizes the revenues in the period the cash was received.

This is also known as the realization principle. So, revenue can only be recognized once the underlying goods or services associated with the revenue have been delivered or rendered, respectively. Thus, revenue can only be recognized after it has been earned. So, according to this concept, any change in the value of an asset is to be recorded only when the business realizes it.

That means, that when assets are recorded at historical value, any change in value is to be accounted for only when it is realized. Most business accounting records are better kept on an accrual basis. This also generates another principle; the matching concept.

Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Matching Concept:

This concept implies that there are expenses associated with any revenue. Therefore, it insists that revenue-associated expenses should be matched to the revenues recognized in the same accounting period. That is why such expenses must be recorded in the period the revenues were generated.

A cash basis does not do this. And where revenue and associated expenses are not matched, the accounting analysis and appraisals may not show the real truth of the matters. This is Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Consistency:

The consistency principle looks simple. Yes, it is. But it’s an instruction, that whatever method you adopt you must continue to use it for a very long time. Put in another way, According to the consistency concept, once a business has decided on a particular method for treating an accounting item, it will treat all similar items in the same way in the future.

That is why business accounting principles are not often changed. So Next time your small boy/girl accountant/cashier tells you “Oga, we can not change this” please do understand.

Going concern – Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Going concern is an accounting term that implies that an entity can go on existing indefinitely as long as they have the resources needed to continue operating indefinitely until it provides evidence to the contrary. So, the term also refers to a company’s ability to make enough money to stay afloat or to avoid bankruptcy.

Conservation.

This principle tells you to be careful in recognizing gain. It tells you not to count your chicks before they are hatched. Therefore, the conservatism concept is a concept in accounting that tells you that expenses and liabilities should be recognized as soon as possible. Such as in a situation where there is uncertainty about the possible outcome. On the other hand, this concept tells you to record assets and revenues only when they are assured to be received.

Therefore, it ‘s a policy of anticipating possible future losses but not future gains. So, this principles tells you that it’s better to understate rather than overstate net assets and net income. It like saying, please, “play safe”. Please, read more about Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Economic entity/Business Entity:

In accounting, an economic entity is one of the GAAP assumptions. GAAP is a generally accepted accounting principle. This accounting principle simply means that a business entity’s finances should be kept separate from those of the owner.

In fact, owners or owners may include individuals, partners, shareholders, or related businesses. And it’s a reality matter that if you need to succeed in your business you must separate it from yourself or yourselves.

Materiality:

The materiality concept in accounting looks at what is material and immaterial. This concept implies that all the material items should be reported properly in the financial statements. As a matter of fact, by way of definition, material items are considered as those items whose inclusion or exclusion in your financial reports may result in significant changes in the decision-making for the users of the business information.

However, not all items are so material. So, even though the matching concept wants you to record and capitalize all initial business expenses, you find out that the N250.00 used to buy waste baskets is not worth capitalizing. So, you write it off in the year of purchase instead of carrying it on as an asset and depreciating it over the years. The material concept allows you to make this decision.

And let me ask you, will this N250.00 make any material change in your financial report for the year? The answer is NO. You see, I am gradually making you an accountant.

The Accounting equation: Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

The basic accounting equations is

A = L+E

A = assets

L = liabilities

E = equity

Or stated like this; Asset = liabilities + equity

This is the main thrust of the double-entry accounting system. The double-entry system records transactions as debits and credits. In fact, there is this axion that every liability creates an asset. This is true. For instance, if you take a loan of N1m for you. business, you have taken up a liability of N1m and have at the same time created an asset of bank balance/cash of N1m.

Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Full Disclosure Principle:

The Full Disclosure Principle implies that all relevant and necessary information for the understanding of your business financial statements must be included in the financial statement. The full disclosure principle is crucial to ensuring that there is limited information asymmetry between the company’s management and its current shareholders, debtors, or other third parties. This is Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

However, the full disclosure principle does not require the release of every piece of available information to the public. On the contrary, only relevant and material information is disclosed. So, the principle urges the disclosure of information that can have a material impact on the company’s financial results or financial position.

As there are many of user information needed of financial statements, so it’s necessary to attend to such needs. For example, financial analysts who read financial statements need to know what inventory valuation method has been used. They want to know if there have been any significant write-downs. In fact, they want to know how depreciation is being calculated, and other critical information for the understanding of the financial statements.

The Objectivity Principle: Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principle

This principle demands that your business financial statements should be objective. And, that means that the accounting information should be unbiased and free from any external or internal influence. So, this principle keeps the management team and the accounting department of an entity from producing financial statements that are slanted by their opinions and biases.

As a matter of fact, the aim of this principle is to give integrity to your financial statements.

Money Measurement:

This concept tells the accountant how to record business transactions. In fact, it demands that only transactions expressed in terms of money will be recorded. This is about Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

This means that the focus of accounting transactions is on quantitative information. In fact, accountants don’t have much to do with qualitative information. When they do, it’s only added as NOTES.

Accounting Period:

When you hear from a tax man asking you when do you want to make up your account. this is what he means. He wants to know the time frame for which you intend to prepare your financial statements. So, that is the time annually you report your financial performance and position to external stakeholders.

As a matter of fact, these stakeholders may include the government, investors, banks, or other related institutions. Some regulatory bodies like CAC also need copies of your annual reports. It’s good you know this now. This is because many businessmen and women don’t know that this is an annual responsibility.

Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Cost Concept:

Recording your asset purchases is essential. In fact, it helps keep your business’s expenses orderly. So, it’s important you record the acquisition price of anything you spend money on and the time of purchase. That is how to properly record depreciation for those assets.

This concept states that all acquisitions of items should be kept in the record at historical cost. That is the cost of purchase. So, assets or items needed for expending should be recorded and retained in books at cost. Therefore, if a balance sheet shows an asset at a certain value, it should be assumed that this is its historical cost less accumulated depreciation.

Duality Aspect concept: Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

We had hinted at this in the Accounting Equation discussed above. The dual aspect concept is also known as the double-entry system of accounting. This states that every business transaction requires recording in two different accounts. This concept is required by all accounting frameworks in order to produce reliable financial statements.

What then is the dual aspect concept formula? What is the result of the double-entry accounting? As a matter of fact, every double-entry record results in the Accounting equation; Assets = Liabilities + Capital. This is because the two sides of the account; debit and credit must balance. We had earlier stated that every liability creates an asset as in the equation above. But look at this too. Liabilities = Capital – Assets. Just the same thing. I have just made Liability the subject of the equation.

For Professional qualifications and recruitment, click here

Read Also: Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Do you know that this covers other entrepreneurial interests you may wish to know about? So, click to read.

- Free Accounting Basics For Non-Accountant Entrepreneurs in Nigeria

- UK, USA, Canada, Australia Scholarships to apply

- Foreign Scholarship maters

- UK, USA, Canada Tourist and student Visas

- Student working hours in UK

- Recruitment tips

- Professional Tips

- Get Wealth growth Inspiration here

Summing Up on Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles

Yeah! I have nearly made you an Accountant. Anyway, I am happy for this write up. I have been able to fulfil this desire of mine to let people know what these concepts and principles are. And, in fact, how they affect their business. At any rate, how these affect your business will be the subject of another discussion.

And, I know you enjoyed it. And, that is why you must contact us for your Accounting, Auditing nd Taxation exercises. We can help you fix your internal control system. Then, we handle all your incorporation returns at CAC and ensure you get your contract bidding compliance certificates duly on time.

Why not bookmark this page? And then, follow us on our Facebook pages and help share this to reach your friends. Sharing is made simple here by your clicking on any of the social media buttons on this page. Then, contact us at +234 9053130518/08034347851 or email via [email protected]. Get inspired here Thanks for reading through Non-Accountant Entrepreneurs: How to apply Basic Accounting Concepts and Principles