Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System – Are you a non-accountant CEO, then This post is for you. The focus is to let you understand how the accounting system in your office works. This is because the accounting system in your office hinges on the double-entry bookkeeping system. So, read more here about Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

Contents

- 1 The Post Focus:

- 1.1 Non-Accountant CEOs: Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

- 1.2 Bookkeeping System & Double Entry System:

- 1.3 Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

- 1.4 Understand how the double Entry bookkeeping accounting system works:

- 1.5 Related Topics on Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System:

- 1.6 Important Concepts:

- 1.7 Read Also: Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

- 1.8 Summing Up on Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

- 1.9 Share this:

- 1.10 Like this:

The Post Focus:

This post focus is on these concepts outline here for discussion. Their understanding will help the non-accountant CEOs manage their businesses better. So, please read on.

Non-Accountant CEOs: Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

A chief executive officer, the highest-ranking person in a company or other institution. In fact, the CEO is responsible for taking managerial decisions. Now, is the CEO the owner of the company? This may not be so. This is because The CEO who is in charge of the overall management of the company may not be the owner. On the other hand, the owner who has sole proprietorship of the company may not be the CEO. However, it is possible that the CEO of a company is also the owner.

Furthermore, one of the most essential aspects of running a business is the accounting. In fact, a solid accounting strategy can make the difference between a profitable and a failing business. That is why we think every CEO must be knowledgeable in basic accounting practices so as to know if their company’s strategy is sound or not. This is Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

One of the major focuses of this post is hereby addressed. Did you understand it? Now, we can go ahead to discuss the double-entry bookkeeping accounting system.

Bookkeeping System & Double Entry System:

Bookkeeping is the process of recording your business financial transactions in organized accounts/classes/categories on a daily basis. This my involve the use of different recording techniques by different businesses. We highlighted this in our previous article. Click here to read it. In fact, Bookkeeping is an essential part of your accounting process for many reasons.

This is because proper bookkeeping gives companies/businesses a reliable measure of their performance. In fact, it also provides information to make general strategic decisions. This may be for a benchmark for its revenue and income goals. Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

Furthermore, what are the three types or areas that bookkeeping focuses? This is very important for non-accountant CEOs. Please, note that your bookkeeping system must focus and incorporate costing, managerial, and financial accounting. Therefore, for example, your revenue may be classified into revenue from sales, revenue from rental income, revenue from interest income etc.

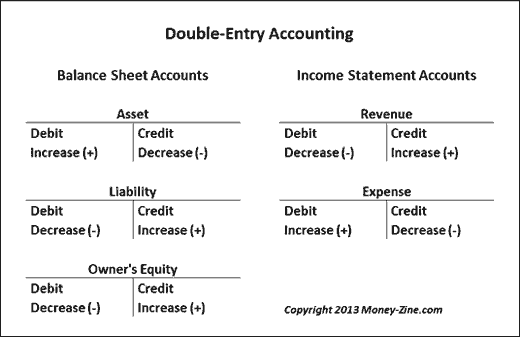

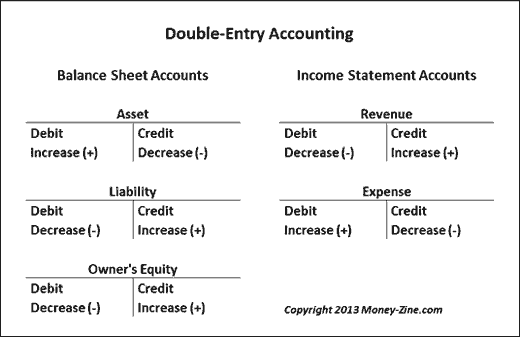

In the next paragraph we shall see that the double entry system has two corresponding sides known as Debit and Credit. It’s a system that follows the accrual basis of accounting as we explained in an earlier article.

Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

Understand how the double Entry bookkeeping accounting system works:

Double-entry bookkeeping is a method of recording transactions. This type of recording ensures that for every business transaction, an entry is recorded in at least two accounts. One on the debit side and the other in the credit site of the account. It shows a receiver and the giver. The axiom is “debit the receiver and credit the giver”. That is why in this system, the amounts recorded as debits must be equal to the amounts recorded as credits.

As a matter of fact, double-entry accounting is a method of bookkeeping that tracks where your money comes from and where it’s going. So, the two entries, a “debit” and a “credit” describe whether money is being transferred to or from an account, respectively. This all about Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

In summary, the basis of the double-entry bookkeeping system is that every transaction must have two parts and affects two ledger accounts.

My dear non-accountant CEO, I think this has taken care of some of the confusion you have in understanding why the same figure appears here and there again and again in your books.

Related Topics on Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System:

In this series, the following topics are covered. We think it will do you a great good to click on them for more information.

- Accounting Definition – Accounting basics

- Users of Financial Accounting Information

- Basic accounting Concepts and Principles

- Accounting Equation

- The Rules of Debit and Credit

- Double Entry Bookkeeping System

- Accounting Cycle, i.e., analyzing, recording, classifying, summarizing, and interpreting

- You are expected to cross-reference these topics by clicking on them to read accordingly.

Important Concepts:

In this Series, we would want our readers to understand the following concepts properly. The accounting basics on accounting categories are summarized below:

- Assets. – Items of financial value that the business controls (“owns”) for the purpose of producing income for the owners.

- Liabilities. – Monies that the business owes to non-owners.

- Owners Equity. – The theoretical value of the business that would be distributed to the owners after the assets were sold and the liabilities paid.

- Revenue. – Payments made to the business by customers for the goods and/or services provided by the business.

- Expenses. – Costs incurred by the business in providing the goods and/or services purchased by the customers.

Read Also: Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

Do you know that this covers other entrepreneurial interests you may wish to know about? So, click to read.

- Free Accounting Basics For Non-Accountant Entrepreneurs in Nigeria

- UK, USA, Canada, Australia Scholarships to apply

- Foreign Scholarship maters

- UK, USA, Canada Tourist and student Visas

- Student working hours in UK

- Recruitment tips

- Professional Tips

- Get Wealth growth Inspiration here

Summing Up on Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System

And, I know you enjoyed this article. That is why you must contact us for your Accounting, Auditing, and Taxation challenges In fact, we can help you fix your internal control system. Then, handle all your incorporation returns at CAC and ensure you get your contract bidding compliance certificates duly on time.

So, why not bookmark this page? And then, follow us on our Facebook pages and help share this to reach your friends. Sharing is made simple here by your clicking on any of the social media buttons on this page. Then, contact us on +234 9053130518/08034347851 or email via cessummit0518@gmail.com. Get inspired here

To get more information on this website, use our search button on this page. Just type in whatever you want, and this site will give you that. Thanks for reading through Non-Accountant CEOs: How you may Understand Double Entry Bookkeeping System