How to measure small business profitability

How to measure small business profitability – When we develop a business plan for you, what profitability indicators should you watch out for? In this article we let you know how to measure the profitability of a small and medium-scale business or company from your business plan feasibility analysis.

These business profitability calculators will show you how to tell if a company is profitable from the income statement. In addition, are how to calculate profitability percentage and how to tell if a company is profitable from the balance sheet. Here is How to measure small business profitability

Contents

- 1 Cessummit.com business info:

- 1.1 How to measure small business profitability

- 1.2 Profitability:

- 1.3 Profitability indicators:

- 1.4 How to measure small business profitability

- 1.5 How to measure small business profitability

- 1.6 How to measure small business profitability

- 1.7 Read Also:

- 1.8 Where to get help:

- 1.9 Share this:

- 1.10 Like this:

Cessummit.com business info:

A feasibility analysis is always attached when we develop your business start-up or scale-up business plan. Cessummit.com gives free tutorials like this for her clients and readers. Here now are what you need to know from your business proposals and feasibility analysis. Always rely on us for business information. This site has a lot of it. Just use our search button on this page to search for any business concept or clause of your choice.

How to measure small business profitability

Profitability:

The income remaining after settling all expenses in a business is called profit. There are 3 forms of profit. These are gross profit, operating profit, and net profit. The profit margin is the profit expressed as a percentage of the revenue or income. This margin shows how well a company uses revenue.

Furthermore, Profitability is the expression of the profit in relationship with the expenses. So, it’s a measure of an organization’s profit relative to its expenses always measured as a ratio or percentage. When an Organization realizes more profit as a percentage of its expenses, such an organization is said to be running its operations efficiently. Read more about How to measure small business profitability

So, what is the profitability of a small business? Generally, a healthy profit margin for a small business tends to range anywhere between 7% to 10%. However, certain businesses may see lower margins, such as retail or food-related companies, and still doing well.

Profitability indicators:

In this section, we want to explain some of these profitability indicators and how you can calculate them. This becomes very important for start-ups that need to interpret the business plan they have on hand. And for those scaling up their businesses, the knowledge of these factors will enable you to know where you are and where you are going.

The profitability indicators to address here include gross profit margin, operating profit margin, net profit margin, EBITDA, return on assets, return on invested capital and return on equity.

How to measure small business profitability

Gross Profit Margin.

Gross profit margin – compares gross profit to sales/revenue. It’s calculated as gross profit divided by the total revenue times 100 to be in percentage i.e. GP/Revenue X 100

Operating Profit Margin.

There is this profit figure generated before deducting taxes and interest expenses, that is the Operating Profit. It is expressed as a ratio or as a percentage of the total revenue to generate the operating profit margin. i.e. operating profit/turnover X 100/1

Net Profit Margin.

As a matter of fact, Net profit is gross profit less operating expenses and admin expenses. That means what is left after deducting operating expenses, depreciation, amortization, interest, and income taxes.

When this net income is expressed as a percentage of the total revenue or turnover, what we have is the net profit margin.

How to measure small business profitability

EBITDA Margin:

In addition, EBITDA means earnings before interest, taxes, depreciation, and amortization. It tells how much profit is made before interest, taxes, depreciation, and amortization, as a percentage of revenue.

Return on Assets.

Return on assets (ROA) indicates how profitable a business is with its total assets.

A Good Return on Assets Ratio of 5% or lower might be considered low, while a ROA over 20% is high. However, it’s better to compare the ROAs of similar companies.

Return on Equity.

Return on equity (ROE) tells us how much a shareholder is gaining from the business. It’s the measure of a company’s net income divided by its shareholders’ equity. The higher the ROE, the better the company’s opportunity at converting its equity financing into profits. Again, this is How to measure small business profitability.

Return on Invested Capital.

Furthermore, Return on invested capital (ROIC) assesses a company’s efficiency in turning its capital into profitable investments. The ROIC is gotten by dividing net operating profit after tax (NOPAT) by invested capital. ROIC tells us how well a company is using its capital to generate profits.

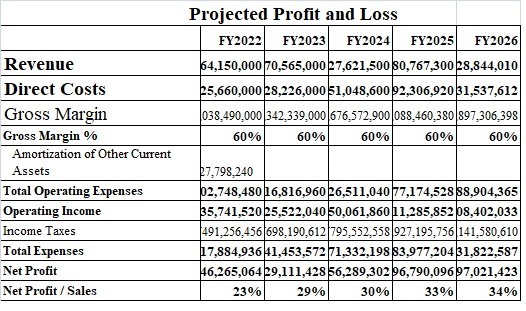

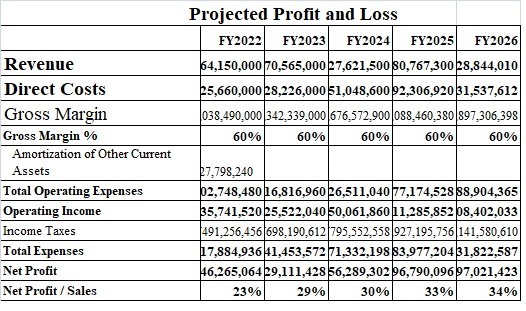

Furthermore, this table showcases some of the profitability indicators narrated above. All of our business plans with feasibility analysis must show something like this. Cessummit uses this medium to bring the importance of these business profit measurement concepts closer to your understanding. Order a business plan from us today and all of these shall follow.

How to measure small business profitability

Read Also:

- Small Capital businesses: which one can I start now?

- What are cottage industries: Here are the lucrative ones

- What are the top 10 businesses to start now now?

- Other feasibility factors

- The objectives of feasibility study

- The amazing feasibility study format

Where to get help:

Finally, help comes from Cessummit.com for How to measure small business profitability. This becomes very important for your business plan and feasibility analysis development. Well, not to worry; Contact us today at +234 905 313 0518, or [email protected]. Thanks for reading through How to measure small business profitability.