The Potential Challenges of Adopting E-Naira in Business Operations

The Potential Challenges of Adopting E-Naira in Business Operations – As the world embraces the digital era, cryptocurrencies have gained significant attention as a potential alternative to traditional currencies. In Nigeria, the adoption of the E-Naira, a digital currency issued by the Central Bank of Nigeria (CBN), has emerged as a promising step toward transforming the country’s financial landscape. While the E-Naira holds the potential to revolutionize business operations and enhance financial inclusion, its adoption is not without challenges. This article on The Potential Challenges of Adopting E-Naira in Business Operations, explores some of the potential hurdles and considerations that businesses may encounter when integrating the E-Naira into their operations, shedding light on both the opportunities and obstacles that lie ahead.

Contents

- 1 Why should members of the public read The Potential Challenges of Adopting E-Naira in Business Operations?

- 1.1 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.2 Introduction:

- 1.3 Security Concerns

- 1.4 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.5 Regulatory Framework

- 1.6 Technological Infrastructure

- 1.7 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.8 User Adoption and Acceptance

- 1.9 Volatility and Financial Stability

- 1.10 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.11 Financial Inclusion and Accessibility

- 1.12 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.13 Conclusion

- 1.14 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.15 Related Topics:

- 1.16 The Potential Challenges of Adopting E-Naira in Business Operations

- 1.17 Read More:

- 1.18 The Potential Challenges of Adopting E-Naira in Business Operations:

- 1.19 Share this:

- 1.20 Like this:

Why should members of the public read The Potential Challenges of Adopting E-Naira in Business Operations?

Reading “The Potential Challenges of Adopting E-Naira in Business Operations” can provide members of the public with valuable insights into the complexities and potential risks associated with the adoption of the E-Naira in business operations. Here are a few reasons why this article can be beneficial:

- Awareness of emerging trends: Cryptocurrencies and digital currencies have been gaining traction globally, and the E-Naira represents Nigeria’s foray into this domain. By reading this article, members of the public can stay informed about the latest developments in the financial sector and understand how the adoption of the E-Naira might impact businesses and the overall economy.

- Understanding potential hurdles: The article on The Potential Challenges of Adopting E-Naira in Business Operations delves into the challenges businesses may face when integrating E-Naira into their operations. This can help entrepreneurs, investors, and stakeholders anticipate and prepare for these obstacles, enabling them to make informed decisions and mitigate potential risks.

- Financial inclusion implications: The adoption of digital currencies like the E-Naira can enhance financial inclusion by providing easier access to financial services, especially for the unbanked population. By reading this article, members of the public can better understand how the E-Naira can contribute to financial inclusion efforts and foster economic empowerment.

The Potential Challenges of Adopting E-Naira in Business Operations

- Business adaptation strategies: The article highlights considerations that businesses should take into account when integrating E-Naira into their operations. It offers insights into the necessary adjustments, such as infrastructure upgrades, security measures, and regulatory compliance, which can help businesses navigate the adoption process more effectively.

- Stimulating informed discussions: As the E-Naira evolves, discussions around its benefits and challenges are crucial. Reading this article can equip members of the public with valuable knowledge and perspectives, enabling them to engage in meaningful conversations, contribute to the ongoing discourse, and collectively shape the future of Nigeria’s financial landscape.

By delving into The Potential Challenges of Adopting E-Naira in Business Operations, this article empowers readers with the knowledge and foresight necessary to navigate the evolving digital currency landscape in Nigeria.

The Potential Challenges of Adopting E-Naira in Business Operations

Introduction:

A. Brief overview of the concept of E-Naira

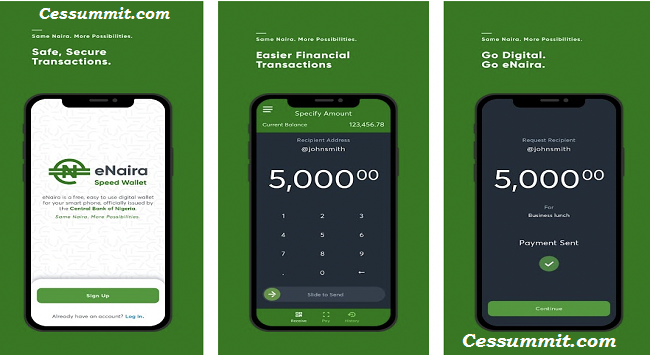

The E-Naira refers to the digital currency issued by the Central Bank of Nigeria (CBN). It is a form of electronic cash that operates as a legal tender, allowing individuals and businesses to make transactions using digital means. The introduction of the E-Naira aims to modernize Nigeria’s financial system, enhance financial inclusion, and promote a cashless economy.

B. Mention the growing trend of digital currencies

Digital currencies have gained significant traction in recent years, with the rise of cryptocurrencies like Bitcoin, Ethereum, and many others. These digital currencies operate on decentralized networks known as blockchains, offering several advantages such as secure and fast transactions, reduced fees, and greater accessibility. The increasing popularity of digital currencies has sparked interest among governments and central banks worldwide to explore the possibility of introducing their own central bank digital currencies (CBDCs).

C. Thesis statement: The adoption of the E-Naira in business operations may present several challenges that need to be considered.

The introduction of the E-Naira in business operations is a significant step toward digitalizing Nigeria’s economy. However, its implementation may bring about certain challenges that businesses and stakeholders should carefully consider. In this essay, we will explore some of these challenges and discuss potential solutions to ensure a smooth transition to the E-Naira system.

The Potential Challenges of Adopting E-Naira in Business Operations

Security Concerns

A. Discuss the vulnerability of digital currencies to cyberattacks

Digital currencies, including the E-Naira, are susceptible to cyberattacks due to their digital nature. Hackers can target various points of vulnerability, such as exchanges, wallets, or the underlying technology itself. Cyberattacks can result in significant financial losses and damage to the trust and credibility of the E-Naira system.

B. Highlight the risks of hacking and identity theft

One of the primary risks associated with digital currencies is hacking. If a hacker gains unauthorized access to a user’s E-Naira wallet or transaction data, they can steal funds or manipulate transactions. Additionally, identity theft can occur if personal information linked to E-Naira accounts is compromised. This can lead to financial fraud and potential loss of trust in the system.

C. Mention the need for robust security measures to protect E-Naira transactions

On The Potential Challenges of Adopting E-Naira in Business Operations, the need to address security concerns, robust security measures must be implemented to safeguard E-Naira transactions. This includes encryption techniques, multi-factor authentication, secure storage of private keys, and regular security audits. The Central Bank of Nigeria must collaborate with cyber-security experts to develop and maintain a secure E-Naira infrastructure.

The Potential Challenges of Adopting E-Naira in Business Operations

Regulatory Framework

A. Explain the importance of a clear and comprehensive regulatory framework for digital currencies

A clear and comprehensive regulatory framework is essential for digital currencies like the E-Naira to operate effectively and safely. Such a framework provides legal clarity, establishes guidelines for businesses and users, and helps mitigate risks associated with money laundering, terrorist financing, and other illicit activities. It also fosters consumer protection and ensures fair market practices.

B. Discuss the challenges of creating and implementing such regulations

Creating and implementing regulations for digital currencies pose several challenges. Firstly, the regulatory framework should strike a balance between protecting users and fostering innovation. It must also keep pace with the rapidly evolving technology and adapt to emerging risks. Additionally, coordination among various government agencies, central banks, and international bodies may be required to develop unified regulations.

The Potential Challenges of Adopting E-Naira in Business Operations

C. Address potential conflicts with existing financial regulations and policies

Introducing a digital currency like the E-Naira may create conflicts with existing financial regulations and policies. It is crucial to assess and address these conflicts to avoid legal uncertainties and inconsistencies. This may involve revisiting and adapting traditional financial regulations to accommodate digital currencies and ensuring compatibility between the E-Naira system and other financial systems in the country.

By addressing security concerns and establishing a robust regulatory framework, the adoption of the E-Naira in business operations can proceed more effectively, ensuring the safety and stability of the digital currency ecosystem.

The Potential Challenges of Adopting E-Naira in Business Operations

Technological Infrastructure

A. Highlight the need for a reliable and scalable technology infrastructure to support E-Naira transactions

For the successful adoption of the E-Naira, reliable and scalable technological infrastructure is crucial. This infrastructure should be capable of handling a large volume of transactions efficiently, ensuring quick and secure transfers. It should also be scalable to accommodate future growth and evolving technological advancements.

B. Discuss potential challenges in terms of system reliability, network connectivity, and compatibility with existing platforms.

Several challenges may arise in terms of system reliability, network connectivity, and compatibility with existing platforms. The E-Naira system should be highly available and resilient to ensure uninterrupted service, even during peak transaction periods. Network connectivity issues, such as internet outages or slow connections, could hinder the smooth functioning of digital currency. Furthermore, compatibility with existing financial platforms and infrastructure can pose integration challenges that need to be addressed to ensure seamless interoperability.

C. Mention the need for continuous technological updates and maintenance

To keep the E-Naira system secure and up to date, continuous technological updates and maintenance are essential. This includes regular software patches, security audits, and system enhancements. Technology evolves rapidly, and the Central Bank of Nigeria needs to stay ahead of potential vulnerabilities and ensure the E-Naira system remains robust and reliable.

The Potential Challenges of Adopting E-Naira in Business Operations

User Adoption and Acceptance

A. Address the challenge of encouraging widespread adoption of the E-Naira among businesses

One of the challenges in implementing the E-Naira is encouraging widespread adoption among businesses. Some businesses may be hesitant to adopt digital currencies due to concerns about volatility, lack of familiarity, or perceived complexities. The Central Bank of Nigeria should work closely with businesses, highlighting the benefits of using the E-Naira, such as faster transactions, reduced costs, and increased financial inclusion.

B. Discuss potential resistance from businesses and individuals due to unfamiliarity with digital currencies

Resistance from businesses and individuals due to unfamiliarity with digital currencies can hinder the adoption of the E-Naira. Education and awareness campaigns are crucial to address this challenge. The Central Bank of Nigeria should provide comprehensive training and support to businesses and individuals to familiarize them with the E-Naira, its benefits, and how to use it securely. Demonstrating successful use cases and highlighting the convenience of digital transactions can help alleviate concerns.

The Potential Challenges of Adopting E-Naira in Business Operations

C. Mention the importance of education and awareness campaigns to promote acceptance

To promote acceptance of the E-Naira, education, and awareness campaigns are vital. These campaigns should aim to educate businesses, individuals, and the general public about digital currencies, their benefits, and proper usage and security practices. Collaborations with educational institutions, industry associations, and media outlets can help disseminate accurate information and dispel misconceptions, fostering trust and encouraging widespread adoption.

By addressing technological infrastructure challenges and promoting user adoption and acceptance, the E-Naira can overcome barriers and establish itself as a trusted and widely accepted digital currency in business operations.

The Potential Challenges of Adopting E-Naira in Business Operations

Volatility and Financial Stability

A. Discuss the potential risks associated with the volatility of digital currencies

Digital currencies, including the E-Naira, are often subject to price volatility. Rapid and significant price fluctuations can pose risks for businesses, as the value of their assets or revenue can fluctuate unexpectedly. Volatility may also create uncertainty for consumers and hinder their confidence in using digital currencies for transactions.

B. Explain the challenges of maintaining financial stability with E-Naira

Maintaining financial stability with the E-Naira requires careful consideration. Price volatility can impact the stability of the financial system, potentially leading to market speculation, financial imbalances, and systemic risks. Additionally, managing the supply and demand dynamics of the E-Naira to ensure stability poses a challenge for the central bank.

C. Address potential measures to mitigate volatility and ensure stability

To mitigate volatility and ensure financial stability, the Central Bank of Nigeria can implement measures such as market monitoring, liquidity management, and regulatory oversight. These measures may include setting reserve requirements, implementing safeguards against market manipulation, and establishing mechanisms to stabilize the value of the E-Naira. Collaborating with international organizations and adopting best practices from other countries can also provide valuable insights into managing volatility.

The Potential Challenges of Adopting E-Naira in Business Operations

Financial Inclusion and Accessibility

A. Discuss the challenges of ensuring accessibility to E-Naira for businesses of all sizes

Ensuring access to the E-Naira for businesses of all sizes is crucial for promoting financial inclusion. However, smaller businesses may face challenges in terms of technological readiness, financial literacy, and the availability of supporting infrastructure. Providing tailored solutions, simplified interfaces, and support programs can help overcome these challenges and encourage broader participation.

B. Address potential issues related to the digital divide and technological barriers

The digital divide and technological barriers can hinder the widespread adoption of the E-Naira, particularly in rural or under-served areas. Also, on The Potential Challenges of Adopting E-Naira in Business Operations, are limited internet access, lack of digital infrastructure, and low technology literacy can create barriers to entry. Addressing these issues requires investment in infrastructure development, improving internet connectivity, and providing training and support to bridge the technological gap.

The Potential Challenges of Adopting E-Naira in Business Operations

C. Highlight the need for inclusive policies and infrastructure development.

On The Potential Challenges of Adopting E-Naira in Business Operations; Ensure financial inclusion and accessibility, the development of inclusive policies and infrastructure is paramount. This includes initiatives to expand internet connectivity, promote digital literacy programs, and establish physical access points where individuals and businesses can interact with the E-Naira. Collaborating with local communities, financial institutions, and technology providers can help create an ecosystem that facilitates broader access to the E-Naira.

The Potential Challenges of Adopting E-Naira in Business Operations

Conclusion

A. Recap the main challenges of adopting the E-Naira in business operations

The adoption of the E-Naira in business operations presents various challenges that need to be addressed. These challenges include security concerns, the need for a regulatory framework, technological infrastructure requirements, user adoption and acceptance, volatility, and financial stability risks, and ensuring financial inclusion and accessibility.

The Potential Challenges of Adopting E-Naira in Business Operations

B. Emphasize the importance of addressing these challenges effectively.

On The Potential Challenges of Adopting E-Naira in Business Operations, it is crucial to address these challenges effectively to ensure a smooth transition to the E-Naira system. By proactively implementing robust security measures, developing a clear regulatory framework, building reliable technological infrastructure, promoting user adoption and awareness, mitigating volatility risks, and fostering financial inclusion, the potential benefits of the E-Naira can be realized.

C. Discuss the potential benefits of the E-Naira for businesses and the economy, despite the challenges.

Despite the challenges, the adoption of the E-Naira can bring significant benefits to businesses and the economy. It can streamline transactions, reduce costs, increase financial inclusion, and promote economic growth. By overcoming the challenges through strategic planning, collaboration, and continuous improvement, the E-Naira has the potential to transform business operations and contribute to Nigeria’s overall economic development.

The Potential Challenges of Adopting E-Naira in Business Operations

Related Topics:

We must consider the following related topics. What are the challenges of the eNaira? What are the challenges of digital currency in an emerging economy? And, what are the impacts of the eNaira on the Nigerian economy? Then, what are the challenges of international business in Nigeria?

The eNaira is a digital currency introduced by the Central Bank of Nigeria (CBN). While the specific challenges of the eNaira may evolve, here are some potential challenges associated with digital currencies in general and their impact on the Nigerian economy:

- Technological Infrastructure: A robust and secure technological infrastructure is essential for the successful implementation of a digital currency. Nigeria, like many other emerging economies, may face challenges in terms of internet connectivity, cybersecurity, and reliable digital payment systems.

- Financial Inclusion: Digital currencies have the potential to enhance financial inclusion by providing access to financial services for the unbanked population. However, ensuring widespread adoption and accessibility of the eNaira will require addressing issues such as limited access to smartphones, internet connectivity, and digital literacy.

The Potential Challenges of Adopting E-Naira in Business Operations

- Consumer Protection and Fraud Prevention: Digital currencies can be susceptible to fraud, scams, and cyberattacks. The eNaira will need robust security measures to protect users and build trust in the system. Adequate consumer protection regulations and mechanisms will also need to be in place to address potential issues.

- Monetary Policy and Financial Stability: The introduction of a digital currency can have implications for monetary policy and financial stability. The CBN will need to carefully manage the eNaira to ensure it aligns with broader monetary policy objectives, minimizes the risk of inflation or deflation, and maintains the stability of the Nigerian financial system.

The Potential Challenges of Adopting E-Naira in Business Operations

Regarding the impacts of the eNaira on the Nigerian economy:

- Financial Inclusion: The eNaira has the potential to increase financial inclusion by providing digital payment services to unbanked individuals and small businesses. This can spur economic growth, facilitate transactions, and enable access to credit and savings opportunities.

- Cost Efficiency: Digital currencies can reduce transaction costs by eliminating intermediaries and streamlining payment processes. The eNaira may enhance efficiency in the Nigerian economy by reducing transactional friction and improving the speed and cost-effectiveness of financial transactions.

- Cross-Border Transactions: The eNaira has the potential to simplify cross-border transactions, promote international trade, and attract foreign investments. It can facilitate faster and more secure remittances, reducing costs and increasing the flow of funds into the Nigerian economy.

- Government Revenue and Fiscal Policy: The adoption of eNaira can enhance the government’s ability to track financial transactions and improve tax collection. This could contribute to increased government revenue and enable more effective fiscal policies.

The Potential Challenges of Adopting E-Naira in Business Operations

As for the challenges of international business in Nigeria, some key factors include:

- Infrastructure: Nigeria faces infrastructure challenges such as inadequate power supply, poor road networks, and limited access to ports. These factors can increase logistics costs and create bottlenecks in international trade.

- Regulatory Environment: The regulatory landscape in Nigeria can be complex and subject to frequent changes. Foreign businesses may encounter challenges related to licensing, permits, bureaucracy, and compliance with local regulations.

- Corruption and Bribery: Corruption remains a significant challenge in Nigeria and can impact international business operations. Businesses may face demands for bribes or encounter corrupt practices in various sectors, increasing the cost of doing business.

The Potential Challenges of Adopting E-Naira in Business Operations

- Security Concerns: Nigeria has experienced security challenges, including issues related to insurgency, kidnapping, and armed robbery. This can create risks for foreign businesses and impact their operations and investments.

- Cultural Differences: Nigeria is a diverse country with various cultural norms and practices. Understanding and navigating these cultural differences is important for building successful business relationships and avoiding misunderstandings.

It is worth noting that these challenges are not exhaustive and may vary depending on specific industries, regions, and circumstances within Nigeria.

The Potential Challenges of Adopting E-Naira in Business Operations

Read More:

- The Potential Benefits of Adopting E-Naira in Business Operations

- The Role of E-Naira in Fostering Financial Inclusion for Business Owners

- E-Naira and Digital Marketing in Nigeria

- How to Harness The Power of E-Naira for Cashless Payments in Business

- How E-Naira Will Promote Tax Compliance In Nigeria

- How to Write Winning Proposals that Close Deals

- How to Raise Funds for Your Project by Crowdfunding

- Cessummit.com Services Offerings: What we do & How

- Profitable Business Idea

The Potential Challenges of Adopting E-Naira in Business Operations:

In conclusion, on The Potential Challenges of Adopting E-Naira in Business Operations, while the adoption of the E-Naira in business operations holds significant potential, it is essential to acknowledge and address the potential challenges that may arise. These challenges include the need for robust cybersecurity measures to protect against cyber threats, ensuring widespread access to digital infrastructure and technology, addressing concerns regarding privacy and data protection, and managing the transition from traditional financial systems to a digital currency.

The Potential Challenges of Adopting E-Naira in Business Operations

Furthermore, on The Potential Challenges of Adopting E-Naira in Business Operations, effective collaboration between regulatory bodies, financial institutions, businesses, and technology providers will be crucial to overcome these challenges and create a conducive environment for the successful integration of the E-Naira into business operations. With careful planning, strategic implementation, and continuous monitoring and evaluation, these challenges can be managed, and the E-Naira can emerge as a transformative force in the business landscape, fostering financial inclusion, efficiency, and innovation.