How to Harness The Power of E-Naira for Cashless Payments in Business

How to Harness The Power of E-Naira for Cashless Payments in Business – In today’s digital age, embracing cashless payments has become increasingly vital for businesses to thrive and stay ahead of the competition. The introduction of the E-Naira, a digital currency issued by the Central Bank of Nigeria, presents a tremendous opportunity for businesses to harness the power of electronic transactions and revolutionize their payment systems. By adopting the E-Naira, businesses can streamline their financial operations, enhance customer convenience, and unlock a host of benefits that come with embracing a cashless economy. In this guide, we will explore how businesses can effectively leverage the power of the E-Naira to drive cashless payments and propel their growth in the digital era.

Contents

- 1 The Post Focus:

- 1.1 How to Harness The Power of E-Naira for Cashless Payments in Business:

- 1.2 Introduction

- 1.3 Understanding the E-Naira

- 1.4 Implementing the E-Naira in Business

- 1.5 Promoting E-Naira Adoption

- 1.6 Ensuring Security and Privacy

- 1.7 Overcoming Challenges

- 1.8 Tracking and Analyzing E-Naira Payments

- 1.9 Conclusion

- 1.10 How to Harness The Power of E-Naira for Cashless Payments in Business

- 1.11 Related topics:

- 1.12 How to Harness The Power of E-Naira for Cashless Payments in Business

- 1.13 Cessummit Integrated Business Development Services:

- 1.14 How to Harness The Power of E-Naira for Cashless Payments in Business

- 1.15 Read More:

- 1.16 How to Harness The Power of E-Naira for Cashless Payments in Business

- 1.17 Share this:

- 1.18 Like this:

The Post Focus:

Why must business people read How to Harness The Power of E-Naira for Cashless Payments in Business? That is why you must read this article.

Business people should read “How to Harness The Power of E-Naira for Cashless Payments in Business” for several compelling reasons. Firstly, the E-Naira represents a significant development in the financial landscape, with the potential to reshape the way transactions are conducted. By understanding how to leverage this digital currency, business people can stay at the forefront of technological advancements and adapt their operations to meet changing consumer preferences.

Secondly, cashless payments offer numerous advantages for businesses, such as increased efficiency, improved security, and enhanced customer experience. Learning how to effectively harness the power of the E-Naira will enable business people to tap into these benefits, streamline their financial processes, and optimize their overall operations.

How to Harness The Power of E-Naira for Cashless Payments in Business

Moreover, as the world becomes increasingly interconnected, businesses need to keep up with the evolving digital ecosystem. By familiarizing themselves with the concepts and strategies outlined in the guide, business people can expand their knowledge of electronic payments, digital currencies, and the broader trends shaping the financial industry. This knowledge will empower them to make informed decisions, identify new opportunities, and maintain a competitive edge in an ever-changing business landscape.

Lastly, on How to Harness The Power of E-Naira for Cashless Payments in Business, reading the guide will provide practical insights and actionable steps for implementing the E-Naira into business operations. From understanding the registration process to integrating E-Naira payment solutions, the guide will equip business people with the necessary knowledge to navigate the digital payment landscape successfully.

In conclusion, “How to Harness The Power of E-Naira for Cashless Payments in Business” is a valuable resource that offers business people a comprehensive understanding of the E-Naira and its potential impact on their operations. By reading this guide, business people can embrace digital transformation, optimize their financial processes, and position themselves for success in an increasingly cashless economy.

How to Harness The Power of E-Naira for Cashless Payments in Business:

Introduction

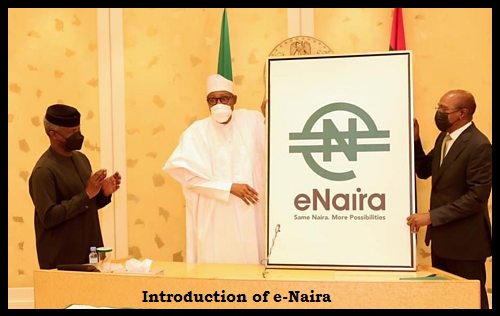

A. The E-Naira is a digital currency introduced by the Central Bank of Nigeria (CBN) to facilitate electronic payments and promote financial inclusion in Nigeria. It is a form of digital money that can be used for various transactions. B. Cashless payments are becoming increasingly important in business due to their efficiency, convenience, and security. They eliminate the need for physical cash, reduce the risk of theft, and streamline financial transactions.

Understanding the E-Naira

A. The E-Naira is a digital currency issued and regulated by the Central Bank of Nigeria. It is designed to be a secure, transparent, and efficient means of conducting electronic transactions. Some key features of the E-Naira include:

- Digital form: The E-Naira exists purely in electronic form, stored in digital wallets or accounts.

- Legal tender: The E-Naira holds the same legal status as physical cash and can be used for various transactions.

- Centralized control: The CBN oversees the issuance, distribution, and regulation of the E-Naira.

- Accessibility: The E-Naira aims to promote financial inclusion by providing access to digital financial services for individuals and businesses.

- Interoperability: The E-Naira can be used across different platforms and financial institutions, enabling seamless transactions.

How to Harness The Power of E-Naira for Cashless Payments in Business

B. There are several benefits associated with using the E-Naira for cashless payments:

- Convenience: With the E-Naira, individuals, and businesses can make transactions anytime and anywhere through digital platforms. This eliminates the need for physical cash or visiting a physical bank.

- Security: Digital transactions using the E-Naira are generally more secure than carrying physical cash. The risk of theft or loss is minimized, and transactions can be protected by encryption and authentication measures.

- Efficiency: The E-Naira enables faster and more efficient transactions, reducing the time spent on cash handling and counting. This can lead to increased productivity for businesses.

- Cost-effectiveness: Cashless payments through the E-Naira can be more cost-effective than handling physical cash. Businesses can save on cash handling expenses, such as transportation, storage, and security measures.

- Financial inclusion: The E-Naira aims to provide access to financial services for unbanked or underbanked individuals. It can empower people with limited access to traditional banking services to participate in the digital economy.

In conclusion, the E-Naira is a digital currency introduced by the Central Bank of Nigeria to facilitate cashless payments and promote financial inclusion. It offers various benefits such as convenience, security, efficiency, cost-effectiveness, and increased accessibility to financial services. Its adoption can contribute to the growth and development of businesses in Nigeria.

How to Harness The Power of E-Naira for Cashless Payments in Business

Implementing the E-Naira in Business

A. Setting up an E-Naira account: To start using the E-Naira, businesses need to set up an account with a financial institution that supports E-Naira transactions. This typically involves providing necessary documentation and completing the registration process.

B. Integrating E-Naira payment systems: Businesses should integrate E-Naira payment systems into their existing infrastructure. This may involve working with payment service providers or adopting compatible point-of-sale (POS) systems and online payment gateways that support E-Naira transactions.

C. Ensuring compatibility with existing payment infrastructure: It is essential to ensure that the E-Naira payment systems are compatible with the business’s existing payment infrastructure. This may require software updates or hardware modifications to support E-Naira transactions seamlessly.

How to Harness The Power of E-Naira for Cashless Payments in Business

Promoting E-Naira Adoption

A. Educating employees and customers about the E-Naira: Businesses should provide training and educational materials to employees to familiarize them with the E-Naira and its usage. Customer awareness campaigns can also be conducted to educate them about the benefits and convenience of using the E-Naira for transactions.

B. Incentivizing the use of E-Naira for payments: Offering incentives, such as discounts or loyalty rewards, can encourage customers to use the E-Naira for their purchases. Businesses can also consider special promotions or exclusive deals for customers who make payments using the E-Naira.

C. Collaborating with other businesses to support E-Naira adoption: Partnering with other businesses that accept the E-Naira can create a network effect and increase its adoption. By collaborating with suppliers, vendors, and service providers, businesses can create a seamless ecosystem where the E-Naira becomes widely accepted.

How to Harness The Power of E-Naira for Cashless Payments in Business

Ensuring Security and Privacy

A. Implementing robust security measures: Businesses should implement strong security measures to protect their E-Naira transactions. This may include encryption protocols, secure payment gateways, multi-factor authentication, and regular security audits.

B. Safeguarding customer data and financial information: Businesses must prioritize the protection of customer data and financial information. This involves implementing data protection measures, complying with privacy regulations, and adopting secure data storage practices.

How to Harness The Power of E-Naira for Cashless Payments in Business

C. Staying updated on security best practices and regulations: Businesses must stay informed about evolving security best practices and comply with relevant regulations. Regularly updating software, monitoring for security vulnerabilities, and staying abreast of industry standards can help maintain a secure E-Naira payment environment.

By following these implementation strategies and prioritizing security, businesses can effectively integrate the E-Naira into their operations, promote its adoption, and ensure a secure and efficient cashless payment system for their customers.

How to Harness The Power of E-Naira for Cashless Payments in Business

Overcoming Challenges

A. Addressing concerns about system reliability and downtime: Businesses should work closely with their technology partners and service providers to ensure robust system infrastructure that minimizes the risk of downtime. Implementing backup systems and regularly conducting system maintenance and updates can help address reliability concerns.

B. Providing customer support for E-Naira transactions: It is crucial to establish a dedicated customer support system to assist customers with any issues or queries related to E-Naira transactions. This can include a helpline, email support, or online chat support to address customer concerns promptly and efficiently.

C. Managing potential resistance to change from employees and customers: Change management strategies should be employed to address resistance to adopting the E-Naira. This can involve comprehensive training programs for employees, highlighting the benefits of the E-Naira, and addressing any concerns or misconceptions. Engaging with customers through education and awareness campaigns can help alleviate their resistance and encourage adoption.

How to Harness The Power of E-Naira for Cashless Payments in Business

Tracking and Analyzing E-Naira Payments

A. Utilizing analytics tools to gain insights: Implementing analytics tools can help businesses track and analyze E-Naira payment data. This data can provide valuable insights into transaction patterns, customer preferences, and overall business performance.

B. Monitoring transaction trends and customer behavior: By analyzing E-Naira payment data, businesses can identify trends in customer behavior, such as popular products or services, peak transaction times, and preferred payment methods. This information can inform business strategies and decision-making.

C. Using data to optimize business operations and customer experiences: The insights gained from E-Naira payment analytics can be used to optimize various aspects of business operations. This can include inventory management, pricing strategies, targeted marketing campaigns, and personalized customer experiences. By leveraging data, businesses can improve efficiency, increase customer satisfaction, and drive growth.

How to Harness The Power of E-Naira for Cashless Payments in Business

By proactively addressing challenges and harnessing the power of data analytics, businesses can successfully navigate the implementation of the E-Naira, overcome obstacles, and leverage the benefits of digital payments to drive their success in the evolving financial landscape.

How to Harness The Power of E-Naira for Cashless Payments in Business

Conclusion

A. Recap of the benefits of harnessing the power of the E-Naira for cashless payments: Embracing the E-Naira offers businesses numerous benefits, including convenience, security, efficiency, cost-effectiveness, and increased accessibility to financial services. It enables businesses to streamline their operations, provide a seamless payment experience for customers, and contribute to the growth of Nigeria’s digital economy.

B. Encouragement to embrace the E-Naira and leverage its potential in business: As the world moves towards a cashless society, businesses need to embrace digital payment solutions like the E-Naira. By adopting the E-Naira and integrating it into their operations, businesses can stay ahead of the curve, meet evolving customer preferences, and unlock new opportunities for growth and success.

How to Harness The Power of E-Naira for Cashless Payments in Business

C. Future outlook for the E-Naira and the evolving landscape of cashless payments: The E-Naira represents a significant step toward a digital economy in Nigeria. As technology continues to advance and digital payments become more prevalent, the E-Naira is likely to play a pivotal role in transforming financial transactions. Businesses need to stay updated on emerging trends, technological advancements, and regulatory developments to adapt and thrive in the evolving landscape of cashless payments.

In conclusion, on How to Harness The Power of E-Naira for Cashless Payments in Business; the E-Naira presents businesses with a unique opportunity to embrace cashless payments, improve efficiency, and enhance customer experiences. By understanding its features, implementing it effectively, addressing challenges, and leveraging data analytics, businesses can harness the power of the E-Naira and contribute to the growth of a digital economy in Nigeria.

How to Harness The Power of E-Naira for Cashless Payments in Business

Related topics:

Learn more on How to Harness The Power of E-Naira for Cashless Payments in Business. So, here are solutions to questions like; Can eNaira be used for international transactions? How does the cashless policy affect the economic growth of Nigeria? What can I do with Naira? These are some o the questions discussed in this segment. Others include; What is Nigeria’s cashless policy? How to make money with e-naira, e-naira benefits, and Agro e naira wallet

- Can eNaira be used for international transactions? The decision to allow eNaira for international transactions would depend on the policies and regulations set by the Central Bank of Nigeria (CBN) and the Nigerian government.

- How does the cashless policy affect the economic growth of Nigeria? The cashless policy in Nigeria aims to reduce the use of physical cash and promote electronic payment systems. By encouraging the use of digital transactions, the policy aims to enhance transparency, reduce corruption, and improve the efficiency of financial transactions. A shift toward cashless transactions can also lead to increased financial inclusion and formalization of the economy, as more people and businesses gain access to financial services. These factors, in turn, have the potential to support economic growth by facilitating greater participation in the formal economy and enabling efficient resource allocation.

- What can I do with eNaira? The specific use cases and features of the e-Naira would be determined by the CBN and the Nigerian government. Generally, eNaira is expected to serve as a digital form of the Nigerian currency, providing a means for electronic transactions and reducing reliance on physical cash. Potential use cases could include making payments, transferring funds, conducting online transactions, and possibly even integrating with various financial services such as savings, loans, and investments.

- What is Nigeria’s cashless policy? Nigeria’s cashless policy was introduced by the CBN in 2012 to reduce the amount of physical cash in circulation and encourage the use of electronic payment methods. The policy includes measures such as imposing cash handling charges on large cash withdrawals and deposits, promoting the use of electronic payment channels (e.g., cards, mobile banking, online transfers), and implementing initiatives to increase financial inclusion and the adoption of digital financial services. The specific details and implementation guidelines of the policy can vary, and it is advisable to refer to official sources or the CBN for the most up-to-date information.

How to Harness The Power of E-Naira for Cashless Payments in Business

- How to make money with eNaira? The ways to make money with eNaira would depend on the specific features and services associated with the digital currency. It is important to note that cryptocurrencies and digital currencies can carry risks, and any investment or money-making opportunities should be approached with caution. If eNaira allows for investments or financial services, potential avenues to consider could include trading, investing, or participating in various digital financial platforms and services that may emerge around eNaira. However, it is essential to conduct thorough research, seek advice from financial professionals, and stay updated on relevant regulations and guidelines.

- eNaira benefits The benefits of eNaira would likely include increased convenience, efficiency, and security in financial transactions. Some potential advantages could be:

- Reduced reliance on physical cash: eNaira can promote a shift towards digital payments, reducing the need for carrying cash and associated risks.

- Enhanced financial inclusion: Access to digital financial services can be extended to more individuals and businesses, enabling participation in the formal economy and facilitating economic growth.

- Transparency and accountability: Digital transactions can leave an audit trail, contributing to greater transparency and helping combat corruption and financial crimes.

- Improved efficiency: Electronic transactions can be faster and more convenient than traditional cash-based transactions, leading to time savings for individuals and businesses.

- Potential integration with financial services: Depending on the eNaira implementation, it may offer features such as savings, loans,

How to Harness The Power of E-Naira for Cashless Payments in Business

Cessummit Integrated Business Development Services:

Cessummit Integrated Services provide business development services. Cessummit Integrated Services is a highly reputable company dedicated to delivering comprehensive and effective business development services. With a wealth of experience and expertise, Cessummit excels in assisting organizations across various industries to achieve their growth objectives, enhance operational efficiency, and maximize their overall potential.

One of the core areas of expertise offered by Cessummit Integrated Services is strategic planning. Recognizing that a well-defined strategy is vital for long-term success, their team of seasoned professionals collaborates closely with clients to develop tailored strategic plans that align with their unique goals and aspirations. By conducting thorough market research, analyzing industry trends, and evaluating internal capabilities, Cessummit helps businesses create a roadmap for sustainable growth, competitive advantage, and increased profitability.

How to Harness The Power of E-Naira for Cashless Payments in Business

In addition to strategic planning, Cessummit Integrated Services provides comprehensive market research and analysis. They employ a combination of quantitative and qualitative research methodologies to gather essential data about target markets, customer preferences, and industry trends. By leveraging this valuable information, Cessummit assists clients in making informed business decisions, identifying emerging opportunities, and mitigating potential risks.

Cessummit’s business development services also encompass sales and marketing strategies. Understanding the critical role of sales and marketing in driving revenue growth, their experts work closely with clients to develop result-oriented plans. This includes defining target customer segments, formulating pricing strategies, implementing effective marketing campaigns, and establishing robust sales processes. By optimizing these key areas, Cessummit helps businesses enhance their brand visibility, attract new customers, and foster long-term customer loyalty.

Furthermore, Cessummit Integrated Services offers assistance in identifying and securing funding opportunities. They have extensive knowledge of various financing options available, including traditional loans, venture capital, angel investors, and government grants. Leveraging its strong network of financial institutions and investors, Cessummit assists clients in preparing compelling business proposals, conducting due diligence, and navigating the complex landscape of fundraising. Their goal is to help organizations secure the necessary capital to fuel their growth initiatives and realize their strategic objectives.

How to Harness The Power of E-Naira for Cashless Payments in Business

Overall, Cessummit Integrated Services is a trusted partner for businesses seeking professional guidance and support in their business development endeavors. Their comprehensive suite of services empowers organizations to overcome challenges, seize opportunities, and achieve sustainable growth in an increasingly competitive marketplace. With their strategic insights, industry knowledge, and commitment to client success, Cessummit remains at the forefront of driving business excellence and fostering long-term prosperity. Please feel free to contact us at [email protected] or call us at 09053130518.

How to Harness The Power of E-Naira for Cashless Payments in Business

Read More:

- How E-Naira Will Promote Tax Compliance In Nigeria

- How Digital Currencies Impact Business Regulations in Nigeria

- Unlocking the Power of Blockchain: A Guide for Entrepreneurs

- Driving Business Growth through Effective Product Development

- Authentic Sample Business Proposal for Cement Supply Business

- How to Write Winning Proposals that Close Deals

- How to Raise Funds for Your Project by Crowdfunding

- Cessummit.com Services Offerings: What we do & How

- Profitable Business Idea

How to Harness The Power of E-Naira for Cashless Payments in Business

In conclusion, embracing the power of the E-Naira for cashless payments in your business can revolutionize the way you conduct transactions. By leveraging the convenience, security, and efficiency offered by this digital currency, you can streamline your operations, enhance customer experience, and stay ahead in the competitive market. Remember to educate yourself and your staff about the intricacies of the E-Naira, integrate compatible payment systems, and prioritize cybersecurity measures to safeguard sensitive data. With careful planning and strategic implementation, you can harness the full potential of the E-Naira, unlocking a new era of cashless payments and propelling your business toward greater success in the digital age. Embrace the future today and reap the rewards of a thriving cashless ecosystem.