Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit – The question is; How do you apply debit and credit in accounting? What does Debit or Credit mean in accounting? How do the CEOs understand these jargons? Well; for accounting, the book is divided into two sides. So, the debit sides are always on the left.

And, then, the credits are always on the right side. And, following the accounting Equation principle, the two sides should always equal each other in the end for your accounts to remain in balance. This is Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

Contents

- 1 The Post Focus:

- 1.1 Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

- 1.2 Debit and Credit in Accounting:

- 1.3 The Rules for Debit and Credit Entries:

- 1.4 Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

- 1.5 The Different Impacts:

- 1.6 Non-Accountant Entrepreneurs:

- 1.7 Now you can read also:

- 1.8 Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

- 1.9 Do you need help?

- 1.10 Summing Up on Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

- 1.11 Share this:

- 1.12 Like this:

The Post Focus:

Our focus here is how to let the non-accountant entrepreneur understand how his books of account are kept. By understanding how the rules of Debit and Credit principles work, he will be able to understand his financial records. This understanding also will enable him/her to know how to interpret and apply the variables to generate the essential parameters needed to run or manage his business. Now, read more about Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit.

As a matter of fact, related to this topic are other topics covered in this website;

- How non-accountant CEOs should understand Accounting Equation,

- How non-accountant entrepreneurs understand Accounting Debit and Credit Rules,

- Free Accounting Basics for Non-Accountant CEOs:

- How entrepreneurs see Accounting Circle and

- Accounting Definition – Accounting basics

- Users of Financial Accounting Information

- Basic accounting Concepts and Principles

- The Rules of Debit and Credit

- Double Entry Bookkeeping System

- Accounting Cycle, i.e., analyzing, recording, classifying, summarizing and interpreting

You are expected to cross reference these topics by clicking on them to read accordingly.

Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

Debit and Credit in Accounting:

How to apply Rules of Debit and Credit. This concerns business financial transactions. This system of debit and credit is developed to be able to record such transactions properly. This system records such events through two different accounts. That is why it’s also called double entry system.

However, it is good to understand that the net effect of these accounting entries is the same in terms of quantity. The ledge is a principal book of account where these things/entries happen. So, in the ledger account, usually the debit column is on the left and the credit column is on the right. This is the tradition. No questions!

In each scenario a debit entry will either increases an asset or expense account. On the other hand, a debt entry decreases a liability or equity account.

In a second scenario, a credit entry increases either a liability or equity account. And decreases an asset or expense account. The balancing figure is positioned on the right in an accounting entry.

Double Entry System:

Furthermore, whenever an accounting transaction occurs, a minimum of two accounts is always impacted with a debit entry and a credit entry being recorded against each of the relevant accounts. There is no upper limit to the number of accounts involved in a transaction but the minimum cannot be less than two accounts. This is because, one account can have a single debit entry but more than one credit entry to complete the transaction record

Notwithstanding, the totals of the debits and credits for any transaction so recorded must always equal each other. When that happens we say that the account is in balance. so that an accounting transaction is always said to be in balance. Thus, this double entry system is the most effective controls over accounting accuracy.

The Rules for Debit and Credit Entries:

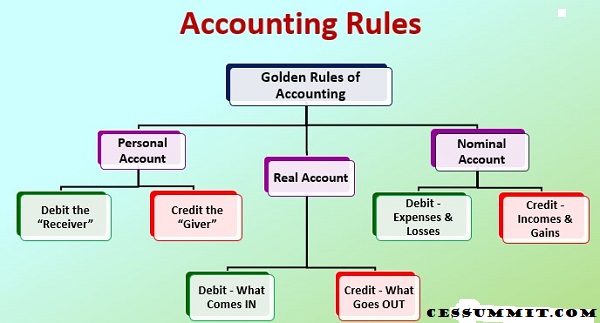

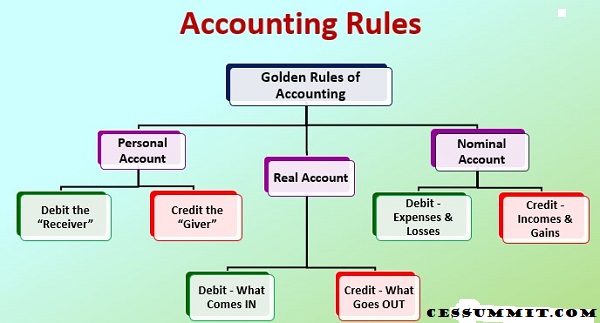

The following are the rules of debit and credit. They are those which guide the system of accounts. In fact, they are known as the Golden Rules of accountancy:

- First: Debit what comes in and Credit what goes out.

- Second: Debit all expenses and losses and Credit all incomes and gains.

- Third: Debit the receiver, Credit the giver.

Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

The Different Impacts:

Furthermore, a debit and credit accounting entry have a broad impact on different accounts. This is an age long tradition. See the following;

Asset accounts:

A debit increases the balance and a credit decreases the balance.

Liability accounts:

A debit decreases the balance and a credit increases the balance.

Equity accounts:

A debit decreases the balance and a credit increases the balance.

Revenue accounts:

A debit decreases the balance and a credit increases the balance

Non-Accountant Entrepreneurs:

My young Non-Accountant Entrepreneurs; I hope you understand how to apply Rules of Debit and Credit in your financial records. This post is meant for you to understand how the double system of accounting works for you. This is based on one of the accounting axions that states that every liability create and asset. So, you see, and Asset is debited while a liability is credited. That’s part of what we explained above.

Now you can read also:

Check out these topics too. They also cover other entrepreneurial interest you may desire to know about. So, click to read also;

- Free Accounting Basics For Non-Accountant Entrepreneurs in Nigeria

- Recruitment tips

- Professional Tips

- Get Wealth growth Inspiration here

- For recruitment information, click here

Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

Do you need help?

Then, check out below for what we can offer you. In fact, there are so much we can offer you. These are service offerings that will help your business startup. So, click to read on and contact us as you go on.

- With A bankable Business Plan for all scope of operation

- Train and apply for CBN/BOI/ NIRSAL MFB AGSMEIS and other loan facilities

- Register your business appropriately with C.A.C.

- Make incorporation changes for you @ C.A.C. – change of MEMART, Director, Shareholding etc.

- Render annual returns for you @ C.A.C. and obtain other certifications/reports for you

- Apply and obtain SCUML certificate for your banking purposes

- Apply and obtain contract bidding compliance certificates for you – PENCOM, NSITF, ITF, BPP IRR, Tax Clearance certificate

- Auditing Services and Tax management services

- Apply and obtain regulatory certificates – Import/Export licenses, NCC licenses, NAFDAC certificates etc.

- And other consultancy services

Summing Up on Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit

Non-Accountant Entrepreneurs: How to apply Rules of Debit and Credit is essential for CEOs entrepreneurs. All relevant meaning and process are enumerated above. At this point, you need to bookmark this page for further refencing. And then, follow us on our face-book pages. Again. help share this to reach your friends. Sharing is made simple here by your clicking on any of the social media buttons on this page. Then, contact us on +234 9053130518/08034347851 or emailing via cessummit0518@gmail.com. Get inspired here And, to get more information on this website, use our search button on this page. Just type in whatever you want, and this site will give you that. Get professional tips here