Monitoring Performance Strategies: A Key to Start-up Business Growth

Monitoring Performance Strategies: A key to Start-up Business Growth. These are methods of measuring business performance. They are means of identifying ways of measuring the success of a Start-up business growth. Now, are you a start-up? Do you want to continually monitor your business growth performances?

We have here the strategies for monitoring your start-up business growth performances. So, read more about Monitoring Performance Strategies: A Key to Start-up Business Growth

Contents

- 1 Financial metrics for startups:

- 1.1 Related Topics on Monitoring Performance Strategies: A Key to Start-up Business Growth

- 1.2 Types of KPI:

- 1.3 Monitoring Performance Strategies: A key to Start-up Business Growth

- 1.4 Line of Business (LOB) Revenue Vs. Target:

- 1.4.1 Line of Business (LOB) Expenses Vs. Budget:

- 1.4.2 Accounts Payable Turnover as a performance indicator:

- 1.4.3 Accounts Receivable Turnover Ratio: Monitoring Performance Strategies: A Key to Start-up Business Growth

- 1.4.4 Inventory Turnover Ratio

- 1.4.5 Return on Equity:

- 1.4.6 Quick Ratio:

- 1.4.7 Customer Satisfaction:

- 1.5 More Related Topics to Read:

- 1.6 Our Offerings:

- 1.7 Summing Up on Monitoring Performance Strategies: A key to Start-up Business Growth

- 1.8 Share this:

- 1.9 Like this:

Financial metrics for startups:

Furthermore, we start with the key financial metrics for startups to watch. They are business performance measurement tools even in the workplace. The Key Performance Indicators (KPIs) are key indicators of progress toward an expected result. These indicators provide a focus for a business strategic and operational improvement. It helps to create an analytical basis for decision-making. In fact, it helps focus attention on what matters most for the business. It also enables industry analysis and comparisons.

Related Topics on Monitoring Performance Strategies: A Key to Start-up Business Growth

- Monitoring Performance Strategies: A key to Start-up Business Growth

- How Neglecting Regulations & Compliance Hinders Growth for Business Start-ups

- When Technology & Innovations Harm Business Start-ups

- See How Narrow Client Base Restricts business Growth

- Leadership Challenges Restrict Business Start-up Growth: See how

- Monitoring Performance Strategies: A Key to Start-up Business Growth

Types of KPI:

As indicated above, key financial indicators are various. Their usage depends on what you want to measure or assess. Cessummit.com has homework for you here. For every start-up and existing business entrepreneur reading this post, you re expected to relate these factors to your business.

Cessummit.com empowers entrepreneurs with modern entrepreneurship empowerment strategies structured in this manner. Our aim is to promote economic growth and development in Nigeria. So, here are some of start up key performance indicators you need for your start-up. Please, read through.

Operating Cash Flow:

Operating cash flow (OCF) measures the amount of cash generation in your business operations. A positive operating cash flow shows that the Start-up business generates sufficient cash flow to maintain and grow its operations. A negative operating cash flow indicates that the start-up requires external financing. As you can see, this is good for performance management and strategic planning.

You can calculate it with any of the following formulas; revenue – operating expenses + depreciation – income taxes – change in working capital. Or net income + depreciation – change in working capital. Or net income – changes in working capital + non-cash expenses. When cessummit.com prepares a business plan for you, the cash flow statement is always auto-generated. Cash flow analysis is here.

Read also non-accountant entrepreneurs need of accounting basics

Working Capital: Monitoring Performance Strategies: A Key to Start-up Business Growth

Working capital refers to the amount a start-up requires to finance the day-to-day operations. It includes cash and cash equivalents such as cash, bank balances, short-term investments like treasury bills. You derive working capital by subtracting Current liabilities from Current Assets = Current Assets – Current Liabilities. When you are planning for strategy and performance management this indicator is important. Working capital analysis is here.

Monitoring Performance Strategies is a key to Start-up Business Growth. So, when you require performance management and strategic planning for high-performance strategy, cessummit.com is there for you. This is because by cessummit.com’s objectives; of empowering entrepreneurs with strategic processes, we adhere to strategy and performance management approaches.

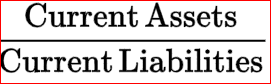

Current Ratio

This is current assets divided by current liabilities. Current assets are those that you can turn around or converted into cash within one year. And, in like manner current liabilities re those obligations you budged for or occurred and must be paid within one year.

The ideal ratio is between 1:2 to 2. This means that your business has 2 times more current assets than liabilities to cover its current debts. So, you can see that where current liabilities are more than current assets, there is a liquidity problem. And, even when it is 1:1, you business is still not at its best. So, for a good strategic planning for high-performance strategy strive to have something more than 1:1.

Debt to Equity Ratio: Monitoring Performance Strategies: A Key to Start-up Business Growth

For high-performance management and strategic planning, it’s important you watch your debt-equity ratio. As a matter of fact, in some businesses, high debt-equity ratio pays a lot while in some others, the reverse is the case. So for high performance strategy, you have to watch your debt-equity ratio.

Furthermore, the formula for calculating the debt-to-equity ratio is simple. Just add up all of your liabilities and divide them by your total shareholders’ equity. An ideal debt-to-equity ratio is generally below 2.0 for most companies and industries. However, for some, 1 to 1.5 is good.

But you must know that some industries run much more with debt financing. At any rate, most small and medium scale businesses are not like that. You can ask for more professional advice from cessummit.com business support services for your business planning consultant services.

Monitoring Performance Strategies: A key to Start-up Business Growth

Line of Business (LOB) Revenue Vs. Target:

Here, the line of business/project revenue can be measured against the budgeted revenue. Line of Business Revenue Vs. Target is an indicator of how a particular line of business or project contributes to the overall business revenue. So, target revenue is the revenue or earnings that a start-up is targeting for a given period. In this regard, target revenue can be set for a year, quarter, month or for any particular project.

Here we go again to explain the importance of Line of Business (LOB) Revenue Vs. Target as a strategic performance indicator. This indicator is good for a make-or-buy decision. It is also good for a project continuation or closedown decision. Read more about Monitoring Performance Strategies: A Key to Start-up Business Growth

Line of Business (LOB) Expenses Vs. Budget:

And, when it comes to project evaluation in terms of budgeted expenditure and actual expenditure, this indicator becomes paramount. As indicated in the last paragraph, this is also good for management decisions for project continuation or discontinuation.

Accounts Payable Turnover as a performance indicator:

Accounts payable turnover is a measure of how many times a business like a start-up up can pay its suppliers and other obligations. This KPI is measured over an accounting period. Because this measure is a short-term financial measure, it’s actually relevant for account payable control measures. Check the Turnover analysis here. Monitoring Performance Strategies: A Key to Start-up Business Growth

The accounts payable turnover ratio is a measure of a start-up business’s liquidity. It defines the business’s ability to pay its debts. So, the higher the accounts payable turnover ratio, the quicker the business pays off its debts. It’s calculated by measuring the average number of days a debt remains unpaid. Dividing this average number by 365 days yields the accounts payable turnover ratio.

Cessummit.com makes business information available at your fingertips all the time. Our training and mentorship schemes will aid you do your business well. They re designed to promote economic growth and development. Contact cessummit.com for your business information/business ideas and business planning.

Accounts Receivable Turnover Ratio: Monitoring Performance Strategies: A Key to Start-up Business Growth

This is another vital Monitoring Performance Strategy for start-ups in Nigeria. As a performance indicator, it promotes good management decision-making.

So, the account Receivable (AR) Turnover Ratio or Debtor’s Turnover Ratio is an accounting measurement of how effective a business like a start-up is in extending credit as well as collecting debts. This is an activity ratio that measures how efficiently a firm uses its assets.

The AR Turnover Ratio is calculated by dividing net sales by average account receivables. Then, net sales re calculated as sales on credit – sales returns – sales allowances. That is, Net Credit Sales / Average Accounts Receivable. On the other hand, average accounts receivables re calculated as the sum of starting and ending receivables over a set period of time divided by two.

Inventory Turnover Ratio

As a matter of fact, every start-up must watch this ratio. This is to avoid overstocking or understocking of goods. These may mean keeping funds idle in stocks or spending funds unnecessarily.

Indeed, Inventory turnover measures the rate at which inventory stock is sold. And how its used or replaced. It’s calculated by dividing the cost of goods by average inventory for the same period. Again a higher ratio points to strong sales and a lower one to weak sales. Monitoring Performance Strategies: A Key to Start-up Business Growth

Return on Equity:

Return on Equity( ROE) measures the profitability of a business in relation to the business equity. Therefore, it’s a measure of financial performance – calculated by dividing net income by shareholders’ equity. On the other hand, it can also be measured in relationship to net assets. This is because shareholders’ equity is also equal to a company’s assets minus its debt.

As a matter of fact, the higher the ROE the more it’s seen as how efficiently a business uses its shareholder’s equity to generate income. So, for business growth and development this monitoring indicator is important. This is Monitoring Performance Strategies: A Key to Start-up Business Growth

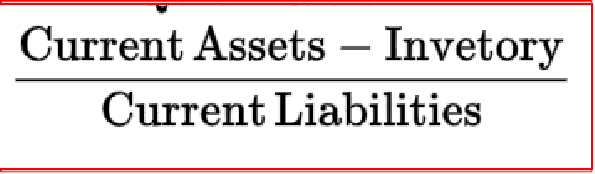

Quick Ratio:

The quick ratio measures the extent to which a business can pay its short-term obligations using its most liquid assets. It measures how cash and cash equivalents can meet up with the payment obligations of short-term obligations. In this regard, a good indicator is given by any ratio number greater than 1.0. So, if your business has a quick ratio of 1.0 and above, that generally means your business is healthy and can pay its short-term liabilities quickly and comfortably.

Get career professional tips here – Monitoring Performance Strategies: A Key to Start-up Business Growth

Customer Satisfaction:

The last growth performance monitoring indicator we are considering is not a financial indicator.

As a matter of fact, if you re interested in your customer satisfaction metrics, you have to work out the business Customer Satisfaction Score. Net Promoter Score and Customer Effort Score. You can do these by Post-service customer surveys, Customer Surveys via Email, and Volunteer feedback.

More Related Topics to Read:

- How Start-ups Can Overcome scaling-up Challenges

- How Time Management becomes a big challenge to business start-ups

- What Growth Strategy can do for a business start-up

- How finding right skills & Behaviors is a business start-up challenge

- Lack of Planning Kills Many Start-ups: See how

- How to Overcome Business Start-up challenges in Nigeria: Funding

- How to Overcome Marketing & Sales Challenges for Start-ups in Nigeria

Our Offerings:

Cessummit.com has a lot to offer you for your business growth and development. They are all strategic because they are important growth planning tools. Your duty here is to click to read your choices and then put a call across to cessummit.com to place your orders.

- How to apply and obtain SCUML certificate for your banking purposes

- To apply and obtain contract bidding compliance certificates for you – PENCOM, NSITF, ITF, BPP IRR, Tax Clearance certificate

- Auditing Services and Tax management services

- Apply and obtain regulatory certificates – Import/Export licenses, NCC licenses, NAFDAC certificates etc.

- And other consultancy services

- With A bankable Business Plan for all scope of operation

- Train and apply for CBN/BOI/ NIRSAL MFB AGSMEIS and other loan facilities

- Register your business appropriately with C.A.C.

- Make incorporation changes for you @ C.A.C. – change of MEMART, Director, Shareholding etc.

- Render annual returns for you @ C.A.C. and obtain other certifications/reports for you

Summing Up on Monitoring Performance Strategies: A key to Start-up Business Growth

In conclusion, we have gone through for you several factors of What Growth Strategy can do for a business start-up. They are growth strategies for start-ups. They are the online services you can grow or franchise from other big entities. They are also factors that promote entrepreneurial opportunities in Nigeria.

Finally, thank you for having gone through What Growth Strategy Can Do for a Business Start-up. And, now cessummit.com thinks it’s time to take action. To do that, follow us on our Facebook page, Twitter handle, Instagram, LinkedIn, and others. Again, it would like you to help share this to reach your friends. Sharing is made simple here by clicking on any of the social media buttons on this page.

Then, contact us at +234 9053130518/08034347851 or email via cessummit0518@gmail.com. Get inspired here, to get more information on this website, use our search button on this page. Just type in whatever you want, and this site will give you that. Get professional tips here and If you want to be come a professional, click here Thanks for reading through Monitoring Performance Strategies: A Key to Start-up Business Growth