Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models – Crowdfunding has emerged as a game-changing phenomenon in the world of finance, disrupting traditional models of financing and empowering individuals and communities to take control of their funding needs. By leveraging the power of the internet, crowdfunding has enabled entrepreneurs, creatives, and social innovators to raise capital for their projects and ideas, bypassing the often complicated and rigid structures of traditional financing. With the rise of crowdfunding platforms, anyone can now access funding from a diverse pool of investors or donors, regardless of their location or financial background. In this article, we will explore how crowdfunding is transforming the financing landscape and creating new opportunities for businesses and individuals alike.

Contents

- 1 Crowdfunding:

- 1.1 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 1.2 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 1.3 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 1.4 crowdfunding is a disruptive force in the traditional financing landscape:

- 1.5 Types of Crowdfunding Explained:

- 1.6 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 1.7 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 1.8 Crowdfunding General Matters:

- 1.9 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 2 Cessummit Business Tips:

- 2.1 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 2.2 Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 2.3 Read Also:

- 2.4 Summing Up: Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- 2.5 Share this:

- 2.6 Like this:

Crowdfunding:

Crowdfunding is a relatively new method of financing that has gained significant popularity in recent years. It involves raising funds from a large number of people, typically through an online platform. In contrast, traditional financing models involve obtaining funding from banks, venture capitalists, or other institutional investors. Crowdfunding offers several benefits over traditional financing models, including greater access to capital for entrepreneurs and more diverse investment opportunities for individuals.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

II. Crowdfunding as a Disruptive Force

Crowdfunding is challenging traditional financing models in several ways. For one, it provides entrepreneurs with access to capital that they might not otherwise be able to obtain. This can be especially important for early-stage startups that are not yet able to attract institutional investors. Additionally, crowdfunding allows investors to participate in projects that they believe in, without requiring them to invest large sums of money. Finally, crowdfunding has been used to finance a wide variety of projects, from new products to artistic endeavors.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

One of the key advantages of crowdfunding for entrepreneurs is that it allows them to maintain greater control over their projects. Because they are not beholden to institutional investors, they can focus on building their businesses in the way that they see fit. For investors, crowdfunding provides the opportunity to support projects that align with their interests and values.

There have been many successful crowdfunding campaigns in recent years. Some notable examples include the Pebble smartwatch, which raised over $10 million on Kickstarter, and the Oculus Rift virtual reality headset, which was acquired by Facebook for $2 billion after raising over $2 million on Kickstarter.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

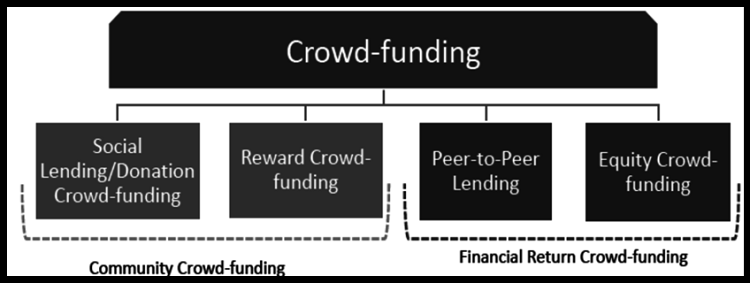

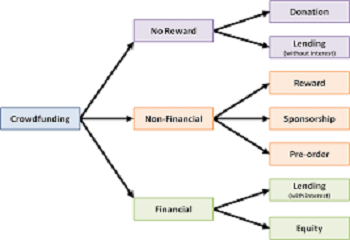

III. Types of Crowdfunding

There are several different types of crowdfunding, including equity crowdfunding, reward-based crowdfunding, donation-based crowdfunding, and debt crowdfunding. Equity crowdfunding involves investors providing funding in exchange for an equity stake in the company. Reward-based crowdfunding involves backers receiving a reward in exchange for their support. Donation-based crowdfunding involves backers providing funds as a donation, typically for charitable or social causes. Debt crowdfunding involves backers lending funds to a company, with the expectation of being repaid with interest.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

IV. Challenges and Limitations of Crowdfunding

While crowdfunding offers many benefits, there are also several challenges and limitations to the model. One of the biggest challenges is regulatory and legal issues. In many countries, there are strict regulations around crowdfunding that can make it difficult for entrepreneurs to raise funds. Additionally, there is a lack of investor protection in many cases, which can leave backers vulnerable to fraud.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models, another challenge is the reputation risk for businesses. If a crowdfunding campaign is not successful, it can be damaging to the company’s reputation. Finally, there is the potential for fraud, as some unscrupulous individuals have taken advantage of the crowdfunding model to scam investors.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

V. Future of Crowdfunding

Despite these challenges, crowdfunding is likely to continue to grow and expand in the coming years. As more entrepreneurs and investors become familiar with the model, it is likely to become an increasingly important part of the financing landscape. Additionally, crowdfunding is likely to become more integrated with other financing models, such as venture capital and angel investing.

Predictions for the future of crowdfunding include the rise of niche crowdfunding platforms that cater to specific industries or audiences, as well as the increased use of blockchain technology to improve security and transparency in crowdfunding transactions.

crowdfunding is a disruptive force in the traditional financing landscape:

In conclusion, to Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models, crowdfunding is a disruptive force in the traditional financing landscape. It offers entrepreneurs and investors many advantages, including greater access to capital and more diverse investment opportunities. While there are challenges and limitations to the model, it is likely to continue to grow and evolve in the coming years, as more people become familiar with the model and new technologies are developed to support it.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Types of Crowdfunding Explained:

Equity crowdfunding:

Equity crowdfunding is a method of raising capital for a business venture by soliciting investments from a large number of individuals, typically through an online platform. Unlike traditional forms of crowdfunding, where individuals donate money in exchange for a reward or product, equity crowdfunding allows investors to buy a stake in the company they are supporting.

Equity crowdfunding can be an attractive option for startups or small businesses that are looking to raise capital but may have difficulty accessing funding from traditional sources, such as banks or venture capitalists. It allows them to tap into a wider pool of potential investors and can be a more democratic way of raising capital, as anyone can invest regardless of their wealth or connections.

However, equity crowdfunding does come with some risks. Investors in equity crowdfunding campaigns typically have less information about the company they are investing in compared to traditional investors and may be more susceptible to fraud or misrepresentation. Additionally, investing in a startup or small business is inherently risky, and investors should be prepared to potentially lose some or all of their investment.

Reward-based crowdfunding:

Reward-based crowdfunding is a method of raising capital for a project or venture by soliciting contributions from a large number of individuals, typically through an online platform. In contrast to equity crowdfunding, where investors receive a stake in the company they are supporting, reward-based crowdfunding allows individuals to contribute money in exchange for a reward or product.

The rewards offered in reward-based crowdfunding campaigns can vary widely, depending on the project or venture being funded. For example, a musician might offer a copy of their album to anyone who contributes to their campaign, while a product designer might offer early access to a new product.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Reward-based crowdfunding can be an attractive option for creators or entrepreneurs who are looking to test the market for a new product or idea and can provide an alternative to traditional funding sources like venture capital or bank loans. By offering rewards to their backers, creators can generate buzz and build a community around their projects, which can help them to attract future customers or investors.

However, it’s important to note that reward-based crowdfunding also comes with some risks. Creators may overpromise or underdeliver on their rewards, leading to disappointed backers. Additionally, there is no guarantee that a project or venture funded through reward-based crowdfunding will be successful, and backers may end up with nothing to show for their contributions.

Donation-based crowdfunding:

Donation-based crowdfunding is a method of raising funds for a cause or charitable organization by soliciting donations from a large number of individuals, typically through an online platform. Unlike reward-based or equity crowdfunding, there is no expectation of receiving any tangible or financial benefit in return for a donation.

Donation-based crowdfunding can be an effective way for charitable organizations or individuals to raise funds for a specific cause, such as disaster relief, medical expenses, or social justice initiatives. By leveraging the power of social media and online networks, donation-based crowdfunding can quickly reach a large number of potential donors, many of whom may not have been reached through traditional fundraising methods.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

However, it’s important to note that donation-based crowdfunding platforms typically charge fees on the donations that are collected, which can impact the amount of funds that are ultimately received by the charitable organization. Additionally, some critics have raised concerns that donation-based crowdfunding may lead to “donor fatigue,” where individuals become overwhelmed by the number of requests for donations and are less likely to contribute to future campaigns.

Overall, donation-based crowdfunding can be a powerful tool for individuals and organizations looking to raise funds for a worthy cause, but it’s important to carefully consider the platform, fees, and potential risks before launching a campaign.

Debt crowdfunding:

Debt crowdfunding, also known as peer-to-peer lending or P2P lending, is a method of raising capital for a business or individual by borrowing money from a large number of individuals, typically through an online platform. In debt crowdfunding, borrowers receive loans from multiple lenders and then repay the loans with interest over a specified period.

Debt crowdfunding can be an attractive option for businesses or individuals that have difficulty accessing traditional forms of financing, such as bank loans. It can also be a more flexible option, as borrowers may be able to negotiate more favorable terms with their lenders than they would with traditional lenders.

For lenders, debt crowdfunding can provide an opportunity to earn a return on their investment that is higher than what they might receive from traditional savings accounts or other investments. Lenders can also diversify their portfolios by investing in multiple loans across different borrowers.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

However, debt crowdfunding also comes with some risks. As with any loan, there is a risk that the borrower may default on the loan, resulting in a loss of the lender’s investment. Additionally, debt crowdfunding platforms typically charge fees on the loans that are made, which can impact the return on investment for lenders.

Overall, debt crowdfunding can be a useful tool for borrowers and lenders alike, but it’s important to carefully consider the risks and potential benefits before participating in a campaign.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Crowdfunding General Matters:

- Is crowdfunding allowed in Nigeria? Yes, crowdfunding is allowed in Nigeria. The Securities and Exchange Commission (SEC) of Nigeria issued a regulatory framework for crowdfunding activities in the country in 2020. The framework provides guidelines for the operation of crowdfunding platforms and protects investors from fraudulent activities.

- How do entrepreneurs use crowdfunding? Entrepreneurs can use crowdfunding to raise capital for their businesses by pitching their ideas or products to a large number of people online. They can offer rewards or equity to their backers in exchange for their support. Crowdfunding can also help entrepreneurs test the market for their products and build a community of supporters.

- Does Crowdfunding have a future in Nigeria? Yes, crowdfunding has a bright future in Nigeria as more entrepreneurs and investors embrace the concept. The potential for crowdfunding to provide access to funding for businesses and support for social causes is enormous in Nigeria, which has a large and growing population of tech-savvy youths.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- Legal Problems Associated with Crowdfunding One of the legal problems associated with crowdfunding is the risk of fraud and scams. Crowdfunding platforms are vulnerable to fraudulent activities, and investors can lose their money to fake projects. Another issue is the lack of clear regulations and guidelines in some countries, which can make it difficult for crowdfunding platforms to operate legally.

- Medical Crowdfunding in Nigeria Medical crowdfunding is a popular form of crowdfunding in Nigeria, where many people struggle to access quality healthcare services. Medical crowdfunding platforms allow individuals to raise funds for their medical expenses and treatment. These platforms have helped many people in Nigeria access life-saving medical care.

- Crowdfunding for NGOs in Nigeria Crowdfunding can be an effective way for non-governmental organizations (NGOs) in Nigeria to raise funds for their projects and activities. NGOs can use crowdfunding platforms to reach a wider audience and generate support for their causes. Crowdfunding can also help NGOs to build relationships with their supporters and increase their visibility.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

- Is crowdfunding legal in Nigeria? Yes, crowdfunding is legal in Nigeria. The SEC issued a regulatory framework for crowdfunding activities in Nigeria in 2020 to provide guidelines for the operation of crowdfunding platforms and protect investors from fraudulent activities.

- Is crowdfunding available in Nigeria? Yes, crowdfunding is available in Nigeria. Several crowdfunding platforms are operating in the country, such as Cowrywise, NaijaFund, and FarmCrowdy, that allows entrepreneurs, individuals, and NGOs to raise funds for their projects and causes.

- Kickstarter funding Kickstarter is a popular crowdfunding platform that allows individuals and businesses to raise funds for creative projects. While Kickstarter is not available in Nigeria, Nigerians can still use other crowdfunding platforms to raise funds for their projects and causes.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Cessummit Business Tips:

Cessummit.com is a comprehensive business platform that provides a wide range of services to entrepreneurs and startups. Their main objective is to help entrepreneurs establish and grow their businesses by offering expert guidance, support, and resources.

One of the key services offered by Cessummit is business incorporation with the Corporate Affairs Commission (CAC) in Nigeria. This means that Cessummit can help you to register your business with the CAC, which is a requirement for any business operating in Nigeria. Incorporating your business with CAC can be a complex process, but with Cessummit’s assistance, you can streamline the process and get your business up and running quickly.

In addition to business incorporation, Cessummit offers a range of other startup services designed to assist entrepreneurs in building and growing their businesses. These services include business planning, feasibility studies, market research, branding and logo design, website development, and more.

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Cessummit’s team of experienced professionals can guide you through each step of the process, from concept development to market entry, helping you to avoid costly mistakes and ensure the success of your business. They can also provide ongoing support and advice to help you navigate the challenges of running a successful business.

If you’re an entrepreneur looking to start or grow a business in Nigeria, Cessummit.com is an excellent resource to help you achieve your goals. To learn more about their services, you can contact them at +234 905 313 0518 or [email protected].

Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

Read Also:

- Tips for Managing Multiple Class Assignments as a Student

- Secrets of Growth Hacking: Tips and Tricks from Successful Entrepreneurs

- 10 Low-Cost Business Ideas for Aspiring Entrepreneurs

- Frugal Entrepreneurship: 5 Low-Cost Business Ideas You Can Start Today

- Mastering Growth Hacking: How to Generate Massive Traffic and Sales

- Profitable Business Planning for Startups

- Cessummit.com Services Offerings: What we do & How

- Profitable Business Ideas

Summing Up: Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models

In conclusion, on Changing the Game: How Crowdfunding is Disrupting Traditional Financing Models, crowdfunding has proven to be a game-changing phenomenon that is disrupting traditional financing models. By enabling individuals and businesses to directly connect with investors and backers, crowdfunding has opened up new avenues of capital for entrepreneurs and startups that may have otherwise struggled to secure funding. However, as with any new development, there are also potential risks and challenges to be addressed, such as the need for adequate regulation and investor protection. Nonetheless, the continued growth and evolution of crowdfunding suggest that it will remain a significant force in the world of finance and investment, and will continue to shape the way that individuals and businesses access capital in the future.