Blockchain Technology: The Future of Financial Services and Banking

Blockchain Technology: The Future of Financial Services and Banking – Do you want to know how Blockchain technology will reshape financial services and baking globally? Then, this article is a must-read for you.

Blockchain technology has emerged as a revolutionary force, poised to reshape the landscape of financial services and banking in the coming years. Do you know that since its inception as the underlying technology behind cryptocurrencies like Bitcoin, blockchain has evolved to become a versatile platform with far-reaching implications? Its decentralized nature, immutability, and transparency offer a host of advantages that address the fundamental challenges faced by traditional financial systems. From secure and efficient transactions to improved data management and reduced fraud, blockchain technology holds immense promise for the future of financial services and banking, paving the way for a more inclusive, trustworthy, and efficient global economy.

Contents

- 1 Why Read This Article:

- 1.1 Blockchain Technology: The Future of Financial Services and Banking

- 1.2 Blockchain technology:

- 1.3 Impact on financial services and banking:

- 1.4 Blockchain Technology: The Future of Financial Services and Banking

- 1.5 The Key Features of Blockchain Technology:

- 1.6 Blockchain Technology: The Future of Financial Services and Banking

- 1.7 Blockchain in Financial Services:

- 1.7.1 Payments and remittances:

- 1.7.2 Cross-border transactions and international settlements:

- 1.7.3 Blockchain Technology: The Future of Financial Services and Banking

- 1.7.4 Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance:

- 1.7.5 Asset tokenization and digital identity:

- 1.7.6 Blockchain Technology: The Future of Financial Services and Banking

- 1.7.7 Supply chain finance and trade finance:

- 1.8 Blockchain Technology: The Future of Financial Services and Banking

- 1.9 Blockchain in Banking

- 1.9.1 Improved efficiency and cost reduction:

- 1.9.2 Streamlined processes and faster settlements:

- 1.9.3 Blockchain Technology: The Future of Financial Services and Banking

- 1.9.4 Fraud prevention and cybersecurity:

- 1.9.5 Customer authentication and data privacy:

- 1.9.6 Blockchain Technology: The Future of Financial Services and Banking

- 1.9.7 Peer-to-peer lending and decentralized finance (DeFi):

- 1.10 Blockchain Technology: The Future of Financial Services and Banking

- 1.11 Challenges and Adoption Barriers

- 1.11.1 Regulatory concerns and compliance issues:

- 1.11.2 Scalability and interoperability:

- 1.11.3 Blockchain Technology: The Future of Financial Services and Banking

- 1.11.4 Integration with legacy systems:

- 1.11.5 Education and awareness:

- 1.11.6 Blockchain Technology: The Future of Financial Services and Banking

- 1.11.7 Standardization and governance:

- 1.12 Blockchain Technology: The Future of Financial Services and Banking

- 1.13 Case Studies and Success Stories:

- 1.13.1 Ripple and the use of blockchain for cross-border payments:

- 1.13.2 JPMorgan Chase’s implementation of Quorum blockchain for securities settlement:

- 1.13.3 Blockchain Technology: The Future of Financial Services and Banking

- 1.13.4 IBM’s partnership with Maersk for blockchain-based supply chain management:

- 1.13.5 Central bank digital currencies (CBDCs) and their potential impact on banking:

- 1.13.6 Blockchain Technology: The Future of Financial Services and Banking

- 1.14 Blockchain Technology: The Future of Financial Services and Banking

- 1.15 Future Trends and Outlook:

- 1.15.1 Integration of blockchain with emerging technologies (AI, IoT, etc.):

- 1.15.2 Interconnected blockchain networks and interoperability:

- 1.15.3 Blockchain Technology: The Future of Financial Services and Banking

- 1.15.4 Regulation and mainstream adoption:

- 1.15.5 The rise of decentralized finance (DeFi) and tokenized assets:

- 1.15.6 Blockchain Technology: The Future of Financial Services and Banking

- 1.15.7 Impact on traditional banking and financial institutions:

- 1.16 Blockchain Technology: The Future of Financial Services and Banking

- 1.17 Related Topics:

- 1.18 Blockchain Technology: The Future of Financial Services and Banking

- 1.19 Other Related Topics:

- 1.20 Blockchain Technology: The Future of Financial Services and Banking

- 1.21 Read More:

- 1.22 Summing up: Blockchain Technology: The Future of Financial Services and Banking

- 1.23 Do you know this?

- 1.24 Share this:

- 1.25 Like this:

Why Read This Article:

Why do we want people to read about Blockchain Technology: The Future of Financial Services and Banking? People should read about Blockchain Technology: The Future of Financial Services and Banking for these reasons. Firstly, blockchain has the potential to revolutionize the financial industry by introducing innovative solutions that enhance security, efficiency, and transparency. Understanding how this technology works and its potential applications can provide individuals with insights into the future direction of financial services and banking.

Secondly, as blockchain gains traction, professionals in the finance sector must stay informed and adapt to the changing landscape. By reading about blockchain technology, individuals can familiarize themselves with its concepts, benefits, and challenges, enabling them to make informed decisions and seize opportunities in their respective fields.

Blockchain Technology: The Future of Financial Services and Banking

Moreover, blockchain technology has the power to disrupt traditional financial systems by offering alternatives that are more inclusive and accessible to underserved populations. This technology has the potential to enhance financial inclusion, improve cross-border transactions, and empower individuals who are currently excluded from traditional banking services.

Furthermore, blockchain technology is not limited to cryptocurrencies but has a broader range of applications. Understanding its potential impact on financial services and banking can inspire individuals to explore new business models, develop innovative solutions, and drive forward-thinking organizational initiatives.

Generally, given the rapidly evolving nature of blockchain technology, staying informed about its advancements and potential future developments can position individuals as thought leaders and subject matter experts. By being well-versed in blockchain technology, individuals can contribute to industry discussions, drive innovation, and shape the future of financial services and banking.

In summary, reading about “Blockchain Technology: The Future of Financial Services and Banking” is essential to stay informed, adapt to industry changes, promote financial inclusion, exploring new opportunities, and contribute to shaping the future of the financial sector.

Blockchain Technology: The Future of Financial Services and Banking

Blockchain technology:

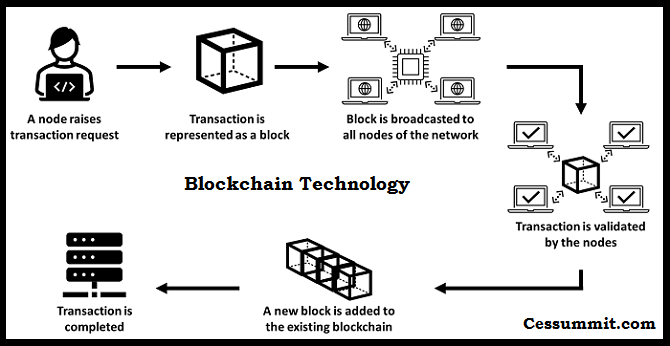

Blockchain technology is a decentralized and distributed digital ledger that records transactions across multiple computers or nodes. It allows participants to maintain a shared and synchronized database without the need for a central authority or intermediary. Each transaction, or block, is linked to a previous block, forming a chain of blocks, hence the name “blockchain.”

Impact on financial services and banking:

Blockchain technology has had a significant impact on financial services and banking. It offers the potential to revolutionize various aspects of these industries by providing increased efficiency, security, transparency, and cost savings. Some of the key areas where blockchain technology has influenced financial services include payments and remittances, trade finance, identity verification, smart contracts, and asset tokenization.

Blockchain Technology: The Future of Financial Services and Banking

The Key Features of Blockchain Technology:

Decentralization and distributed ledger:

One of the fundamental features of blockchain technology is decentralization. Instead of relying on a single central authority, blockchain networks are distributed among multiple participants, known as nodes. Each node has a copy of the entire blockchain, and any updates or transactions are propagated across the network. Decentralization enhances resilience, reduces the risk of single points of failure, and eliminates the need for intermediaries in transactions.

Transparency and immutability:

Blockchain technology provides transparency by allowing all participants to view and verify transactions on the network. Once a transaction is recorded on the blockchain, it becomes immutable, meaning it cannot be altered or tampered with. The immutability of blockchain records increases trust and accountability, as transactions can be audited and verified by anyone on the network.

Blockchain Technology: The Future of Financial Services and Banking

Enhanced security and trust:

Blockchain technology employs advanced cryptographic techniques to secure transactions and data. Each transaction is verified and encrypted before being added to the blockchain, ensuring its integrity and authenticity. Additionally, the distributed nature of the blockchain makes it highly resistant to hacking or data manipulation. This enhanced security and trust are particularly beneficial in financial services, where secure and tamper-proof records are essential.

Blockchain Technology: The Future of Financial Services and Banking

Smart contracts and automation:

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. These contracts automatically execute and enforce the agreed-upon conditions when certain predefined criteria are met. Blockchain technology enables the implementation of smart contracts, eliminating the need for intermediaries and reducing the time and costs associated with traditional contract execution. Smart contracts facilitate automation, increase efficiency, and enable the creation of decentralized applications (DApps) that can operate autonomously.

In general, the key features of blockchain technology, including decentralization, transparency, enhanced security, and smart contracts, have the potential to transform financial services and banking by streamlining processes, reducing costs, and increasing trust and efficiency in transactions.

Blockchain Technology: The Future of Financial Services and Banking

Blockchain in Financial Services:

Payments and remittances:

Blockchain technology has the potential to revolutionize payments and remittances by providing faster, more secure, and cost-effective transactions. Traditional payment systems often involve multiple intermediaries and can be slow and expensive, especially for cross-border transactions. Blockchain-based payment solutions can streamline the process by removing intermediaries, reducing transaction fees, and enabling near-instantaneous transfers. Cryptocurrencies like Bitcoin and stablecoins have emerged as alternative forms of digital currency that leverage blockchain technology for peer-to-peer payments and remittances.

Cross-border transactions and international settlements:

Cross-border transactions and international settlements are often complex and time-consuming due to the involvement of multiple financial institutions, different currencies, and regulatory requirements. Blockchain technology can simplify these processes by providing a decentralized and transparent platform for conducting cross-border transactions. It enables direct peer-to-peer transfers, eliminates the need for intermediaries, and reduces the time and costs associated with traditional settlement systems. Blockchain-based solutions also offer real-time tracking and visibility of transactions, enhancing efficiency and reducing fraud risks.

Blockchain Technology: The Future of Financial Services and Banking

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance:

The KYC and AML processes in financial services require robust identity verification and due diligence to prevent money laundering, terrorist financing, and other illicit activities. Blockchain technology can enhance these processes by creating a secure and immutable digital identity for individuals or businesses. The decentralized nature of blockchain ensures that customer data is stored and shared securely, reducing the risk of data breaches. Blockchain-based KYC solutions enable the efficient sharing of verified customer information among multiple institutions, streamlining compliance processes and reducing duplication of efforts.

Asset tokenization and digital identity:

Blockchain technology enables the tokenization of various assets, including real estate, stocks, bonds, and commodities. Asset tokenization involves representing these assets as digital tokens on a blockchain, allowing for fractional ownership and increased liquidity. This innovation has the potential to unlock new investment opportunities, enable easier access to traditionally illiquid assets, and enhance transparency in asset ownership and transfers. Additionally, blockchain-based digital identity solutions can securely verify and authenticate the ownership and transfer of digital assets, reducing fraud and improving trust in online transactions.

Blockchain Technology: The Future of Financial Services and Banking

Supply chain finance and trade finance:

Blockchain technology can revolutionize supply chain finance and trade finance by improving transparency, efficiency, and trust in these processes. By creating an immutable record of every transaction, blockchain enables real-time tracking and verification of goods as they move through the supply chain. This transparency helps reduce fraud, counterfeiting, and theft, while also streamlining documentation processes for trade finance. Smart contracts can automate trade finance operations, such as verifying shipment deliveries or triggering payments upon certain conditions being met. Blockchain-based supply chain finance solutions can also enable easier access to financing for small and medium-sized enterprises (SMEs) by providing transparent and auditable transaction histories.

As you can see, blockchain technology offers numerous benefits to the financial services industry. It has the potential to transform payments and remittances, simplify cross-border transactions, enhance compliance processes, enable asset tokenization, and improve supply chain and trade finance operations. As technology continues to evolve, its impact on financial services is expected to expand, leading to increased efficiency, security, and innovation in the industry.

Blockchain Technology: The Future of Financial Services and Banking

Blockchain in Banking

Improved efficiency and cost reduction:

Blockchain technology can significantly improve the efficiency of banking operations by reducing the need for intermediaries, automating processes, and providing real-time access to information. It eliminates the need for reconciling multiple ledgers, as all participants have access to a shared, decentralized ledger. This streamlines transaction processing reduces administrative costs, and minimizes the risk of errors or discrepancies.

Streamlined processes and faster settlements:

Traditional banking processes often involve multiple steps, manual verification, and delays in settlement. With blockchain, banks can streamline their processes by digitizing and automating tasks through smart contracts. These self-executing contracts can facilitate the automatic verification and fulfillment of contract terms, leading to faster settlements. Blockchain-based settlement systems can operate 24/7 and significantly reduce the time required for transaction validation, clearing, and settlement.

Blockchain Technology: The Future of Financial Services and Banking

Fraud prevention and cybersecurity:

Blockchain technology enhances fraud prevention and cybersecurity in banking. The immutability and transparency of blockchain records make it difficult for malicious actors to manipulate or tamper with transactions. The decentralized nature of the blockchain reduces the risk of single points of failure and unauthorized access. Additionally, blockchain-based identity verification systems can strengthen customer authentication, reducing the risk of identity theft and fraudulent activities.

Customer authentication and data privacy:

Blockchain technology can enhance customer authentication and data privacy in banking. By leveraging blockchain-based digital identities, banks can securely verify the identities of their customers, reducing the risk of identity theft and fraud. Furthermore, blockchain can provide customers with more control over their data by allowing them to selectively share information with authorized entities, enhancing privacy and giving customers greater ownership of their data.

Blockchain Technology: The Future of Financial Services and Banking

Peer-to-peer lending and decentralized finance (DeFi):

Blockchain enables the emergence of peer-to-peer lending platforms and decentralized finance (DeFi) applications. These platforms allow individuals to lend and borrow funds directly from each other without the need for intermediaries. Smart contracts facilitate the automation of loan agreements, interest payments, and collateral management, reducing costs and increasing accessibility to financial services. DeFi applications built on blockchain provide opportunities for decentralized lending, decentralized exchanges, and other financial services, offering greater inclusivity and potential for higher returns for participants.

In the end, blockchain technology presents significant opportunities for the banking industry. It can improve efficiency, streamline processes, enhance security, and provide innovative financial services. By adopting blockchain, banks can reduce costs, offer new products and services, and deliver enhanced customer experiences while maintaining the necessary regulatory compliance.

Blockchain Technology: The Future of Financial Services and Banking

Challenges and Adoption Barriers

Regulatory concerns and compliance issues:

One of the significant challenges in the adoption of blockchain technology in financial services and banking is regulatory concerns and compliance issues. As blockchain disrupts traditional systems and introduces new concepts like cryptocurrencies and smart contracts, regulatory frameworks need to evolve to address these innovations. Ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, data privacy laws, and consumer protection measures remains a priority. Striking the right balance between innovation and regulation is crucial for widespread adoption.

Scalability and interoperability:

Scalability is another challenge for blockchain adoption in financial services and banking. Public blockchains, like Bitcoin and Ethereum, have faced scalability limitations, leading to slower transaction processing and higher costs during periods of high demand. Interoperability, or the ability of different blockchains to communicate and interact seamlessly, is also a challenge. As various blockchain platforms and networks emerge, establishing interoperability standards becomes essential to ensure compatibility and efficient data exchange between different systems.

Blockchain Technology: The Future of Financial Services and Banking

Integration with legacy systems:

Many financial institutions have existing legacy systems that are deeply integrated into their operations. Integrating blockchain technology with these legacy systems can be complex and costly. The transition from traditional systems to blockchain-powered solutions requires careful planning, risk assessment, and significant investment. Ensuring seamless integration and interoperability between blockchain and legacy systems is crucial to harness the full potential of blockchain technology in banking.

Education and awareness:

Education and awareness about blockchain technology are essential for its adoption in financial services and banking. Understanding the technical aspects, benefits, and potential use cases of blockchain is crucial for decision-makers and stakeholders. Many professionals in the industry may have limited knowledge about blockchain, which can act as a barrier to its adoption. Increasing education and awareness through training programs, workshops, and industry collaboration can address this challenge.

Blockchain Technology: The Future of Financial Services and Banking

Standardization and governance:

The absence of consistent standards and governance frameworks is another challenge for blockchain adoption. The lack of standardized protocols, data formats, and interoperability frameworks can hinder collaboration and limit the scalability of blockchain solutions. Establishing industry-wide standards and governance mechanisms will facilitate the adoption of blockchain technology in financial services and banking. Collaborative efforts among industry players, policymakers, and standardization bodies are necessary to address this challenge.

Overcoming these challenges and adoption barriers requires a collective effort from regulators, financial institutions, technology providers, and other stakeholders. Addressing regulatory concerns, improving scalability and interoperability, ensuring smooth integration with legacy systems, increasing education and awareness, and establishing standardized governance frameworks are crucial steps in promoting the widespread adoption of blockchain technology in financial services and banking.

Blockchain Technology: The Future of Financial Services and Banking

Case Studies and Success Stories:

Ripple and the use of blockchain for cross-border payments:

Ripple, a blockchain-based payments company, has been at the forefront of revolutionizing cross-border payments using blockchain technology. Ripple’s payment protocol, known as RippleNet, leverages the XRP cryptocurrency to facilitate fast and low-cost international money transfers. Ripple’s solutions enable financial institutions to settle cross-border transactions in real time, providing an alternative to the traditional correspondent banking system. Ripple’s partnerships with various banks and payment providers worldwide have demonstrated the potential of blockchain for improving the efficiency and cost-effectiveness of cross-border payments.

JPMorgan Chase’s implementation of Quorum blockchain for securities settlement:

JPMorgan Chase, one of the largest banks in the world, developed its blockchain platform called Quorum for securities settlement. Quorum is a permissioned blockchain designed to enhance the speed and efficiency of securities transactions. It enables real-time settlement, reduces counterparty risk, and improves transparency. JPMorgan has successfully tested Quorum for various use cases, including debt issuance and interbank transfers. The implementation of blockchain technology in securities settlement has the potential to streamline processes, reduce costs, and enhance trust among market participants.

Blockchain Technology: The Future of Financial Services and Banking

IBM’s partnership with Maersk for blockchain-based supply chain management:

IBM partnered with Maersk, a global shipping company, to develop a blockchain-based supply chain management platform called TradeLens. TradeLens aims to digitize and streamline the global supply chain by providing end-to-end visibility, automation, and secure sharing of supply chain data. The platform leverages blockchain technology to create a trusted and immutable record of transactions, enhancing transparency and efficiency. The collaboration between IBM and Maersk has demonstrated the potential of blockchain to address the challenges in supply chain management, including documentation inefficiencies, delays, and fraud.

Central bank digital currencies (CBDCs) and their potential impact on banking:

Central bank digital currencies (CBDCs) have gained significant attention as central banks explore the use of blockchain technology for issuing digital versions of national currencies. CBDCs have the potential to transform banking by providing faster and more efficient payments, reducing reliance on cash, and enabling programmable money. Several countries, including China, Sweden, and the Bahamas, have made progress in developing and piloting CBDCs. The introduction of CBDCs could reshape the financial landscape, offering new opportunities for financial inclusion, enhanced monetary policy tools, and secure digital transactions.

Blockchain Technology: The Future of Financial Services and Banking

These case studies highlight the successful implementation and potential impact of blockchain technology in the financial services and banking sectors. They demonstrate how blockchain can address pain points, improve efficiency, and introduce innovative solutions in areas such as cross-border payments, securities settlement, supply chain management, and the introduction of digital currencies. As more organizations and institutions embrace blockchain technology, further advancements and success stories are expected to emerge, driving the widespread adoption of blockchain in the financial industry.

Blockchain Technology: The Future of Financial Services and Banking

Future Trends and Outlook:

Integration of blockchain with emerging technologies (AI, IoT, etc.):

The integration of blockchain with other emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), holds significant potential. Combining blockchain with AI can enhance data analysis, automation, and decision-making capabilities. Blockchain can provide a secure and transparent infrastructure for IoT devices, enabling trusted interactions and data exchange. The convergence of these technologies can unlock new applications and use cases across various industries, including financial services and banking.

Interconnected blockchain networks and interoperability:

As blockchain ecosystems continue to evolve, the need for interconnected networks and interoperability becomes crucial. Interoperability standards and protocols are being developed to enable seamless communication and data exchange between different blockchain platforms. This interoperability will facilitate the movement of assets and data across various blockchains, unlocking synergies and enabling the creation of decentralized ecosystems.

Blockchain Technology: The Future of Financial Services and Banking

Regulation and mainstream adoption:

Regulatory frameworks for blockchain technology are still evolving, and governments around the world are grappling with the appropriate regulations to ensure consumer protection, data privacy, and financial stability. As the technology matures, clearer regulations are expected to emerge, providing more certainty and fostering mainstream adoption of blockchain in financial services and banking. Regulatory clarity will also encourage traditional financial institutions to embrace blockchain and explore its benefits.

The rise of decentralized finance (DeFi) and tokenized assets:

Decentralized finance (DeFi) has emerged as a prominent use case of blockchain technology, offering innovative financial services without intermediaries. DeFi applications leverage smart contracts to provide decentralized lending, borrowing, staking, and trading. The growth of DeFi has been fueled by the tokenization of assets, allowing fractional ownership and enabling liquidity in traditionally illiquid markets. The tokenization of real-world assets, such as real estate or art, has the potential to democratize investment opportunities and reshape traditional financial markets.

Blockchain Technology: The Future of Financial Services and Banking

Impact on traditional banking and financial institutions:

Blockchain technology poses both challenges and opportunities for traditional banking and financial institutions. While blockchain has the potential to disrupt certain aspects of their business models, it also offers opportunities for collaboration, cost reduction, and enhanced services. Financial institutions are exploring ways to leverage blockchain for improving efficiency, reducing transaction costs, enhancing security, and offering new products and services. The successful integration of blockchain into traditional banking systems will likely require strategic partnerships, regulatory compliance, and a careful balance between innovation and risk management.

Generally, the future outlook for blockchain in financial services and banking is promising. Integration with emerging technologies, interconnected blockchain networks, regulatory advancements, the rise of DeFi, and the impact on traditional institutions are trends that will shape the industry. Continued research, collaboration, and innovation are key to realizing the full potential of blockchain technology and driving its widespread adoption across the financial landscape.

Blockchain Technology: The Future of Financial Services and Banking

Related Topics:

Here are some related topics that make meaning to you.

What are the benefits of blockchain technology in financial services?

Do you know that Blockchain technology offers several benefits in financial services? Now, read about them.

Transparency and immutability: Blockchain provides a transparent and immutable ledger where all transactions are recorded. This transparency reduces fraud and increases accountability as all participants can view and verify transaction details. Once a transaction is recorded on the blockchain, it is nearly impossible to alter or delete, enhancing the integrity of financial data.

Blockchain Technology: The Future of Financial Services and Banking

Enhanced security: Blockchain employs advanced cryptographic techniques to secure transactions. Instead of relying on a centralized authority, blockchain uses a decentralized network of nodes to validate and verify transactions. This distributed nature of blockchain makes it highly resistant to hacking and unauthorized access, improving the overall security of financial systems.

Faster and more efficient transactions: Traditional financial transactions often involve intermediaries, such as banks or clearinghouses, leading to delays and additional costs. Blockchain enables peer-to-peer transactions without intermediaries, eliminating the need for multiple reconciliations and reducing settlement times. This efficiency can significantly streamline processes and lower transaction costs.

Blockchain Technology: The Future of Financial Services and Banking

Cost savings: By removing intermediaries and automating processes, blockchain technology can reduce costs associated with traditional financial services. Smart contracts, which are self-executing agreements on the blockchain, eliminate the need for intermediaries and can automate tasks such as regulatory compliance and document verification, resulting in cost savings for financial institutions.

Increased financial inclusion: Blockchain has the potential to extend financial services to unbanked and underbanked populations around the world. Since blockchain operates on a decentralized network, individuals can access financial services using only a smartphone and an internet connection, bypassing the need for traditional banking infrastructure. This inclusion can empower individuals and businesses that previously lacked access to banking services.

Streamlined identity verification: Identity verification is a critical component of financial services, but it can be time-consuming and cumbersome. Blockchain-based identity solutions offer a more efficient and secure way to verify identities. Users can maintain control over their personal data while granting access to specific entities as needed, reducing the risk of data breaches and identity theft.

Blockchain Technology: The Future of Financial Services and Banking

Improved auditability and regulatory compliance: Blockchain’s transparent and immutable nature simplifies auditing processes and enhances regulatory compliance. Financial transactions recorded on the blockchain can be easily audited, reducing the need for manual reconciliation and providing a reliable source of data for regulatory reporting.

Overall, blockchain technology has the potential to revolutionize financial services by increasing efficiency, reducing costs, improving security, and promoting financial inclusion. However, it is important to note that the widespread adoption of blockchain in the financial sector may still face regulatory, scalability, and interoperability challenges that need to be addressed.

Blockchain Technology: The Future of Financial Services and Banking

Other Related Topics:

This defines the various Benefits of blockchain in finance. So, the benefits of blockchain in finance are numerous and have the potential to revolutionize the industry. So, are these key advantages:

Enhanced Security: Blockchain technology provides a robust and secure framework for financial transactions and data management.

Immutable Ledger: Blockchain’s distributed ledger technology ensures that once a transaction is recorded, it cannot be altered or tampered with, providing a high level of data integrity and auditability.

Cryptographic Security: Transactions on the blockchain are secured through cryptographic algorithms, making it extremely difficult for unauthorized access or fraud to occur.

Prevention of Fraud and Tampering: The decentralized nature of blockchain and its consensus mechanisms make it highly resistant to fraudulent activities, as any alteration to the data would require the consensus of a majority of participants in the network.

Increased Efficiency: Blockchain technology streamlines and automates financial processes, resulting in improved operational efficiency.

Blockchain Technology: The Future of Financial Services and Banking

Removal of Intermediaries: Blockchain eliminates the need for intermediaries, such as banks or clearinghouses, in financial transactions, reducing associated costs and delays.

Faster Transaction Settlements: Blockchain enables near-instantaneous settlement of transactions, eliminating the need for lengthy clearing and settlement processes.

Reduced Processing Times: With blockchain, financial processes can be executed in a more streamlined and automated manner, reducing manual efforts and processing times.

Cost Reduction: Blockchain has the potential to significantly reduce costs across various financial activities.

Lower Infrastructure and Operational Costs: By eliminating the need for intermediaries and reducing manual processes, blockchain can reduce infrastructure and operational expenses for financial institutions.

Smart Contracts: Blockchain enables the use of smart contracts, self-executing agreements with predefined rules, which automate complex financial transactions, further reducing costs.

Improved Transparency: Blockchain brings transparency to financial transactions, enhancing trust and accountability.

Blockchain Technology: The Future of Financial Services and Banking

Enhanced Auditability: The decentralized nature of blockchain allows for transparent and real-time auditing of transactions, reducing the need for extensive reconciliation processes.

Transparent and Traceable Transactions: Every transaction recorded on the blockchain is transparent and traceable, allowing for improved visibility and accountability throughout the financial ecosystem.

These benefits of blockchain in finance have the potential to transform traditional financial systems, increase efficiency, reduce costs, and foster trust among participants in the financial industry. However, it is important to note that implementing blockchain in finance also presents challenges, including scalability, regulatory considerations, and interoperability.

Blockchain Technology: The Future of Financial Services and Banking

Read More:

- Leveraging Blockchain for Secure and Transparent Digital Identity Management

- The Role of Blockchain Technology in Cryptocurrency

- The Potential Benefits of Adopting E-Naira in Business Operations

- The Role of E-Naira in Fostering Financial Inclusion for Business Owners

- E-Naira and Digital Marketing in Nigeria

- How to Write Winning Proposals that Close Deals

- How to Raise Funds for Your Project by Crowdfunding

- Cessummit.com Services Offerings: What we do & How

- Profitable Business Idea

Summing up: Blockchain Technology: The Future of Financial Services and Banking

Blockchain technology has the potential to revolutionize financial services and banking in several ways. It offers decentralization, transparency, enhanced security, and automation through features like distributed ledgers, smart contracts, and immutability. In financial services, blockchain can streamline payments and remittances, facilitate cross-border transactions, improve compliance processes, enable asset tokenization, and enhance supply chain finance. In banking, blockchain can bring improved efficiency, faster settlements, fraud prevention, enhanced customer authentication, and the emergence of peer-to-peer lending and decentralized finance (DeFi).

Blockchain Technology: The Future of Financial Services and Banking

Organizations in the financial services and banking industry must embrace blockchain technology. Blockchain presents opportunities to enhance operational efficiency, reduce costs, provide innovative services, and improve customer experiences. Organizations should proactively explore and experiment with blockchain solutions, identify areas where blockchain can add value, and collaborate with technology providers, industry peers, and regulators to drive adoption. Investing in education and awareness, addressing regulatory concerns, and ensuring seamless integration with legacy systems are essential steps for successful adoption.

The future trajectory of blockchain in the financial services and banking industry looks promising. As the technology matures and regulatory frameworks evolve, we can expect to see increased mainstream adoption and integration with other emerging technologies. Interconnected blockchain networks and interoperability will create synergistic ecosystems, enabling seamless data and asset exchange. The rise of decentralized finance (DeFi) and tokenized assets will reshape traditional financial markets, providing new opportunities for investors and businesses. The successful integration of blockchain into traditional banking systems will require strategic partnerships, regulatory compliance, and a careful balance between innovation and risk management.

Blockchain Technology: The Future of Financial Services and Banking

Do you know this?

Blockchain technology has the potential to transform financial services and banking, driving efficiency, transparency, and security. Embracing blockchain technology and actively exploring its applications will position organizations at the forefront of innovation in the industry. As blockchain continues to evolve and gain mainstream acceptance, its impact on financial services and banking will become increasingly significant, paving the way for a more decentralized, efficient, and inclusive financial ecosystem.