How E-Naira Will Promote Tax Compliance In Nigeria

How E-Naira Will Promote Tax Compliance In Nigeria – The introduction of the E-Naira, Nigeria’s digital currency, has the potential to revolutionize the country’s financial landscape and bring about significant changes in the way taxation is enforced. With its secure and transparent nature, the E-Naira can play a pivotal role in promoting tax compliance among individuals and businesses in Nigeria. By leveraging the benefits of digital transactions and enhancing the government’s ability to track financial activities, the E-Naira is poised to create an environment that encourages greater tax compliance, fosters economic growth, and bolsters the nation’s revenue collection efforts. In this article, we will explore the various ways in which the introduction of the E-Naira can contribute to promoting tax compliance in Nigeria.

Contents

- 1 The Post Focus:

- 1.1 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.2 Introduction

- 1.3 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.4 E-Naira and its Potential Benefits

- 1.5 E-Naira’s Impact on Tax Compliance

- 1.6 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.7 Encouraging Voluntary Tax Compliance

- 1.8 Collaboration with Financial Institutions and Government Agencies

- 1.9 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.10 Public Awareness and Education

- 1.11 Addressing Potential Challenges and Concerns

- 1.12 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.13 Monitoring and Evaluation

- 1.14 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.15 Conclusion

- 1.16 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.17 Cessummit.com Business Tips:

- 1.18 How E-Naira Will Promote Tax Compliance In Nigeria

- 1.19 Read More:

- 1.20 How E-Naira Will Promote Tax Compliance In Nigeria:

- 1.21 Share this:

- 1.22 Like this:

The Post Focus:

Why should entrepreneurs read about How E-Naira Will Promote Tax Compliance In Nigeria? The solution to this is our focus on this post.

Entrepreneurs in Nigeria should be particularly interested in understanding how the introduction of the E-Naira will promote tax compliance in the country. Here are a few key reasons why they should read about this topic:

- Enhanced Financial Transparency: The E-Naira’s digital nature provides a high level of transparency in financial transactions. By adopting the E-Naira, entrepreneurs can ensure that their business activities are accurately recorded and easily traceable. This transparency can serve as a strong deterrent to tax evasion, as it becomes increasingly difficult to hide income or engage in illicit financial practices.

- Simplified Tax Reporting and Payments: The E-Naira can streamline the tax reporting and payment processes for entrepreneurs. With digital records of transactions readily available, entrepreneurs can easily generate accurate financial reports and promptly fulfill their tax obligations. This simplification can save time and effort, allowing entrepreneurs to focus more on their core business operations.

- Reduction in Tax Evasion: The E-Naira’s secure and traceable nature can significantly reduce instances of tax evasion. Illicit activities such as underreporting income or engaging in off-the-books transactions become more challenging with digital currency. Entrepreneurs who comply with tax regulations can have a fairer competitive environment, as tax evaders face a higher risk of detection and penalties.

How E-Naira Will Promote Tax Compliance In Nigeria

- Access to Government Support and Services: Compliance with tax regulations often grants entrepreneurs access to various government support programs and services. By understanding how the E-Naira promotes tax compliance, entrepreneurs can position themselves to leverage these opportunities effectively. This may include accessing funding, grants, training programs, and other initiatives aimed at fostering business growth.

- Positive Economic Impact: Improved tax compliance facilitated by the E-Naira can have a positive impact on Nigeria’s economy as a whole. Increased tax revenues enable the government to invest in infrastructure development, social programs, and public services. These investments, in turn, create a conducive environment for business growth and expansion, benefiting entrepreneurs in the long run.

In conclusion, entrepreneurs in Nigeria should be aware of how the E-Naira will promote tax compliance as it can positively impact their businesses. By embracing digital currency and adhering to tax regulations, entrepreneurs can ensure transparency, simplify their tax obligations, and position themselves to benefit from government support and a thriving economy.

How E-Naira Will Promote Tax Compliance In Nigeria

Introduction

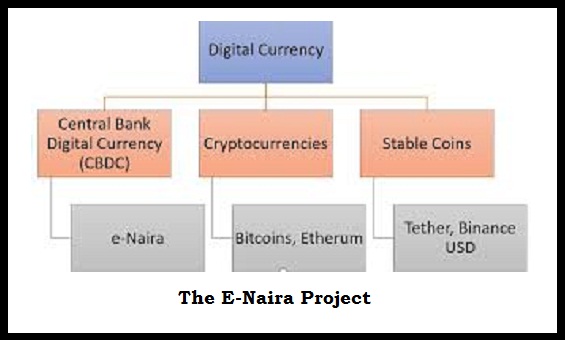

A. E-Naira is Nigeria’s digital currency, introduced by the Central Bank of Nigeria (CBN) to provide a secure and efficient means of digital transactions within the country. It is a digital representation of the Naira, the official currency of Nigeria.

B. Tax compliance plays a crucial role in driving economic growth and development. It ensures that governments have the necessary resources to provide public goods and services, such as infrastructure, healthcare, education, and social welfare programs. When individuals and businesses comply with tax regulations, it fosters trust in the government, promotes economic stability, and enables sustainable development.

How E-Naira Will Promote Tax Compliance In Nigeria

E-Naira and its Potential Benefits

A. E-Naira encompasses various features and functionalities that make it a promising tool for tax compliance. It operates on a blockchain-based platform, ensuring secure and transparent transactions. The digital currency is designed to be easily transferable and can be used for both peer-to-peer transactions and commercial payments.

B. Accessibility and convenience are key advantages of the E-Naira for taxpayers. With digital wallets, individuals and businesses can securely store and manage their digital currency. This accessibility allows taxpayers to easily pay their taxes online, reducing the need for physical visits to tax offices and saving time and effort. The widespread adoption of smartphones and internet connectivity in Nigeria further facilitates the use of the E-Naira for tax compliance.

How E-Naira Will Promote Tax Compliance In Nigeria

C. Enhanced transparency and accountability are inherent in the use of a digital currency like E-Naira. The blockchain technology behind E-Naira records all transactions in a decentralized and immutable ledger. This transparency can help tax authorities in monitoring and verifying transactions, reducing the likelihood of tax evasion and fraud. The increased accountability and traceability offered by E-Naira can improve tax collection efficiency and contribute to a fairer tax system.

In conclusion, the introduction of the E-Naira in Nigeria can have significant benefits for tax compliance. Its features, accessibility, and transparency can streamline the tax payment process, improve efficiency, and foster a culture of compliance among taxpayers. By leveraging the advantages of digital currencies like the E-Naira, Nigeria can strengthen its tax system, promote economic growth, and advance its development goals.

How E-Naira Will Promote Tax Compliance In Nigeria

E-Naira’s Impact on Tax Compliance

A. Increased financial inclusion:

- E-Naira facilitates digital payments for a wider population, including those who may not have access to traditional banking services. By using digital wallets, individuals can participate in the formal financial system and make tax payments conveniently.

- Encouraging formal financial transactions through E-Naira helps bring previously unbanked or underbanked individuals into the formal economy. This expands the tax base and increases the number of taxpayers, contributing to improved tax compliance.

B. Improved tax administration:

- The use of the E-Naira enables digital transaction records, which can provide accurate and verifiable data for tax reporting. This reduces errors and improves the efficiency of tax administration processes.

- Real-time monitoring and enforcement capabilities of the E-Naira platform can assist tax authorities in monitoring transactions, identifying non-compliance, and enforcing tax regulations promptly. This proactive approach helps deter tax evasion and ensures timely enforcement actions.

C. Reduction of tax evasion and informal economy:

- The traceability of digital transactions through the blockchain technology underlying the E-Naira enhances transparency and accountability. Tax authorities can access transaction records, making it easier to identify potential cases of tax evasion and track hidden income.

- By discouraging cash-based transactions and promoting the use of the E-Naira for economic activities, digital currency reduces opportunities for tax evasion in the informal economy. This shift towards formalized transactions contributes to increased tax revenues and a fairer tax system.

How E-Naira Will Promote Tax Compliance In Nigeria

Encouraging Voluntary Tax Compliance

A. Incentivizing taxpayers to use E-Naira:

- Governments can offer discounts or rewards for taxpayers who choose to use E-Naira for their tax payments. These incentives can encourage taxpayers to adopt digital currency and comply with tax regulations.

Collaboration with Financial Institutions and Government Agencies

A. Partnership with banks and financial institutions:

- Integration of E-Naira into existing banking infrastructure allows for seamless transfers of funds between E-Naira wallets and bank accounts. This collaboration simplifies the process of converting digital currency into traditional currency, making it more convenient for taxpayers.

- Collaboration with financial institutions also enables the provision of additional financial services, such as loans or investment options, which can further incentivize taxpayers to use the E-Naira and comply with tax obligations.

How E-Naira Will Promote Tax Compliance In Nigeria

B. Coordination with tax authorities:

- The sharing of transaction data between the E-Naira platform and tax agencies enhances collaboration and information exchange. This enables tax authorities to access relevant data for tax collection, verification, and auditing purposes.

- By streamlining tax collection and verification processes through data integration, E-Naira can reduce administrative burdens for both taxpayers and tax authorities, leading to improved compliance rates.

In summary, the introduction of the E-Naira has the potential to significantly impact tax compliance. It can increase financial inclusion, improve tax administration, reduce tax evasion, and promote the formalization of the economy. By incentivizing voluntary compliance, collaborating with financial institutions and government agencies, and leveraging digital transaction records, E-Naira can help Nigeria build a more efficient and effective tax system.

How E-Naira Will Promote Tax Compliance In Nigeria

Public Awareness and Education

A. Promoting understanding of the E-Naira and its benefits:

- The government, in collaboration with relevant stakeholders, should launch awareness campaigns to educate the public about E-Naira and its benefits for tax compliance. This can include media campaigns, social media outreach, and informational websites.

- Clear and concise communication materials should be developed to explain the features, functionalities, and advantages of using E-Naira for tax payments. These materials should be accessible to different segments of the population, including those with limited digital literacy.

B. Conducting workshops and training programs for taxpayers:

- Workshops and training programs can be organized to familiarize taxpayers with the E-Naira platform, digital wallets, and the process of making tax payments digitally. These training sessions should focus on addressing any concerns or queries that taxpayers may have.

- Collaboration with financial institutions and technology companies can facilitate the provision of training materials, webinars, and interactive sessions to educate taxpayers on using the E-Naira effectively for tax compliance.

C. Highlighting the link between tax compliance and national development:

- Public awareness campaigns should emphasize the connection between tax compliance and the funding of public goods and services that contribute to national development. This can help taxpayers understand the significance of their contributions and foster a sense of responsibility towards their tax obligations.

- Case studies and success stories showcasing the positive impact of tax compliance on community development, infrastructure improvements, and social welfare programs can further illustrate the importance of tax compliance.

How E-Naira Will Promote Tax Compliance In Nigeria

Addressing Potential Challenges and Concerns

A. Cybersecurity measures and protection of personal information:

- The E-Naira platform must prioritize robust cybersecurity measures to safeguard the personal and financial information of taxpayers. This includes encryption protocols, authentication mechanisms, and regular security audits to identify and address vulnerabilities.

- Public education efforts should also include information on how the E-Naira platform ensures data security and privacy, reassuring taxpayers about the protection of their personal information.

B. Ensuring the reliability and stability of the E-Naira platform:

- Continuous monitoring and testing of the E-Naira platform should be conducted to ensure its reliability and stability. This includes stress testing under high transaction volumes and implementing measures to mitigate potential technical issues or system failures.

- Regular updates and maintenance of the platform should be performed to address any identified vulnerabilities or system improvements. Transparency in these processes helps build trust among users.

How E-Naira Will Promote Tax Compliance In Nigeria

C. Assisting individuals without access to digital devices or internet connectivity:

- Alternative methods for tax payment should be made available to individuals who do not have access to digital devices or reliable internet connectivity. This can include designated physical payment centers or partnerships with local entities to facilitate tax payments on behalf of individuals.

- Efforts should be made to improve digital infrastructure and expand internet connectivity to ensure broader access to the E-Naira platform, enabling more individuals to participate in digital tax compliance.

By addressing public concerns, providing education and support, and implementing robust security measures, Nigeria can overcome potential challenges and ensure a smooth transition to the E-Naira platform, promoting widespread adoption and tax compliance.

How E-Naira Will Promote Tax Compliance In Nigeria

Monitoring and Evaluation

A. Regular assessment of the E-Naira’s impact on tax compliance:

- Ongoing monitoring and evaluation should be conducted to measure the effectiveness of E-Naira in promoting tax compliance. This can include tracking the number of taxpayers using digital currency, assessing changes in tax revenue, and monitoring compliance rates.

- Surveys and feedback mechanisms can be implemented to gather insights from taxpayers, tax authorities, and other stakeholders to identify areas for improvement and measure user satisfaction.

B. Adjustments and improvements based on feedback and data analysis:

- Feedback received from taxpayers and stakeholders should be carefully analyzed to identify any challenges or issues with the E-Naira platform and tax compliance processes. Based on this feedback, necessary adjustments and improvements should be made to address concerns and enhance user experience.

- Data analysis of tax compliance trends and patterns can provide valuable insights to inform policy decisions and identify areas where targeted interventions may be required to further improve compliance rates.

C. Collaboration with international organizations for best practices:

- Nigeria can collaborate with international organizations and other countries that have implemented digital currencies for tax compliance purposes. Sharing best practices, experiences, and lessons learned can help enhance the effectiveness and efficiency of E-Naira in promoting tax compliance.

- Engaging in international forums and workshops can provide opportunities for knowledge exchange and enable Nigeria to stay updated on emerging trends and technologies related to digital currencies and tax compliance.

How E-Naira Will Promote Tax Compliance In Nigeria

Conclusion

A. Recap of the role of the E-Naira in promoting tax compliance in Nigeria:

E-Naira, Nigeria’s digital currency, has the potential to significantly improve tax compliance. Its features, such as accessibility, transparency, and convenience, can streamline tax payment processes, enhance accountability, and reduce tax evasion.

B. Emphasizing the potential for economic growth and development:

By fostering tax compliance through E-Naira, Nigeria can increase tax revenues, expand the formal economy, and promote economic growth and development. The resources generated from tax compliance can be utilized for infrastructure development, social programs, and investments in key sectors, leading to overall socio-economic progress.

How E-Naira Will Promote Tax Compliance In Nigeria

C. Call to action for stakeholders to support and embrace E-Naira for tax purposes:

Stakeholders, including individuals, businesses, financial institutions, and government agencies, should actively support and embrace the use of E-Naira for tax compliance. By adopting the digital currency, complying with tax obligations, and participating in related education and awareness initiatives, stakeholders can contribute to the success of the E-Naira and the overall development of Nigeria.

Through continuous monitoring, evaluation, and collaboration, Nigeria can leverage the potential of the E-Naira to create a robust tax compliance ecosystem that fosters economic growth, strengthens governance, and advances the nation’s development goals.

How E-Naira Will Promote Tax Compliance In Nigeria

Cessummit.com Business Tips:

How E-Naira Will Promote Tax Compliance In Nigeria is an entrepreneurial issue, and that’s why cessummit.com is interested in it for its teeming entrepreneur audience. Bookmark this page for future reference.

Certainly! Understanding how E-Naira will promote tax compliance in Nigeria is crucial for entrepreneurs as it directly impacts their business operations and the overall entrepreneurial landscape. Here’s an expanded explanation of the topic:

E-Naira, Nigeria’s digital currency, presents several key advantages that can greatly benefit entrepreneurs and promote tax compliance in the country.

- Simplified Payment Process: E-Naira offers a convenient and streamlined payment process for entrepreneurs to fulfill their tax obligations. With digital wallets and the E-Naira platform, entrepreneurs can make tax payments online, eliminating the need for physical visits to tax offices and reducing administrative burdens. This efficiency saves time and resources, allowing entrepreneurs to focus more on their core business activities.

- Enhanced Financial Inclusion: E-Naira promotes financial inclusion by providing entrepreneurs with access to formal financial services. By utilizing digital wallets, entrepreneurs can participate in the formal economy, establish a transaction history, and access credit or investment opportunities. This inclusion into the formal financial system encourages entrepreneurs to comply with tax regulations, as they can now easily conduct business transactions within the regulated framework.

- Transparent and Traceable Transactions: The blockchain technology underlying E-Naira ensures transparent and traceable transactions. This transparency helps prevent tax evasion and encourages entrepreneurs to accurately report their income and expenses. The immutable nature of blockchain records provides tax authorities with a reliable source of transaction data, enabling them to verify tax compliance and reduce the likelihood of fraud.

How E-Naira Will Promote Tax Compliance In Nigeria

- Real-time Monitoring and Enforcement: E-Naira’s digital platform enables real-time monitoring and enforcement capabilities for tax authorities. This allows for prompt identification of non-compliance and enforcement actions, ensuring a more efficient and effective tax administration system. Entrepreneurs are incentivized to comply with tax regulations, knowing that their activities are being monitored, and non-compliance can result in timely consequences.

- Incentives for E-Naira Adoption: The government can introduce incentives to encourage entrepreneurs to use E-Naira for tax payments. These incentives can include discounts, rewards, or simplified tax filing processes for E-Naira users. Such incentives motivate entrepreneurs to embrace digital currency, promoting tax compliance while benefiting from the advantages it offers.

By understanding how E-Naira promotes tax compliance, entrepreneurs can better navigate the evolving tax landscape in Nigeria. Embracing E-Naira allows entrepreneurs to streamline their tax processes, participate in the formal financial system, and contribute to the growth and development of the country. As such, entrepreneurs should stay informed and engaged with the adoption and implementation of the E-Naira, as it presents opportunities to enhance their business operations and comply with tax regulations effectively.

To stay updated on this topic, bookmarking the page on cessummit.com will provide entrepreneurs with a valuable resource to revisit and explore further in the future.

How E-Naira Will Promote Tax Compliance In Nigeria

Read More:

- How Digital Currencies Impact Business Regulations in Nigeria

- Unlocking the Power of Blockchain: A Guide for Entrepreneurs

- Driving Business Growth through Effective Product Development

- Authentic Sample Business Proposal for Cement Supply Business

- How to Write Winning Proposals that Close Deals

- How to Raise Funds for Your Project by Crowdfunding

- Cessummit.com Services Offerings: What we do & How

- Profitable Business Idea

How E-Naira Will Promote Tax Compliance In Nigeria:

In conclusion, the introduction of the E-Naira in Nigeria presents a significant opportunity to promote tax compliance among entrepreneurs and businesses. By leveraging the features and benefits of this digital currency, such as simplified payment processes, enhanced financial inclusion, transparent transactions, real-time monitoring, and potential incentives, entrepreneurs can navigate the tax landscape more efficiently while contributing to the country’s economic growth and development. Entrepreneurs must stay informed about E-Naira and its implications for tax compliance, and resources like cessummit.com can serve as a valuable reference for their entrepreneurial journey. Embracing E-Naira for tax purposes is not only an entrepreneurial issue but also a critical step toward building a more transparent, accountable, and prosperous business environment in Nigeria.