Professional’s Financial performance indicators to watch in 2025

Professional’s Financial performance indicators to watch in 2025 – Stay ahead in 2025 with these Key financial performance indicators every professional should monitor for success and growth.

Therefore, unlock growth potential with these Essential financial metrics to track for a prosperous 2025. So, Navigate the future with confidence monitoring these Top financial indicators to focus on for 2025’s success. Here are the Professional’s Financial performance indicators to watch in 2025.

Contents

- 1 Professional’s Financial performance indicators to watch in 2025

- 1.1 Professional’s Financial performance indicators to watch in 2025

- 1.2 Category of Financial indicators:

- 1.3 What we offer clients: Professional’s Financial performance indicators to watch in 2025

- 1.4 Related Topics to Professional’s Financial performance indicators to watch in 2025

- 1.5 Summing up:

- 1.6 Share this:

- 1.7 Like this:

Professional’s Financial performance indicators to watch in 2025

Now, look at ten crucial financial performance indicators professionals should monitor in 2025:

- Revenue Growth Rate: This indicator measures the percentage increase in a company’s sales over a specific period. Monitoring revenue growth helps gauge the effectiveness of business strategies and market demand. A consistent growth rate suggests strong business health and expansion potential.

- Operating Margin: The operating margin is the ratio of operating income to revenue. It reflects the percentage of revenue that remains after covering operating expenses. A higher operating margin indicates better efficiency in managing core business operations and costs.

- Return on Equity (ROE): ROE measures how effectively a company uses shareholders’ equity to generate profits. Calculated by dividing net income by shareholder equity, a higher ROE signifies strong financial performance and effective management.

- Net Profit Margin: This ratio is the percentage of revenue remaining after all expenses, including taxes and interest, are deducted. It provides insight into overall profitability and operational efficiency. A higher net profit margin indicates a company is good at converting revenue into actual profit.

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholders’ equity. It indicates financial leverage and risk. A lower ratio suggests a more conservative approach to financing, while a higher ratio could indicate higher risk but potentially greater returns.

- Current Ratio: The current ratio measures a company’s ability to pay short-term obligations with its short-term assets. It’s calculated by dividing current assets by current liabilities. A ratio above 1 suggests sufficient liquidity, while a ratio below 1 may indicate potential liquidity issues.

- Quick Ratio: Also known as the acid-test ratio, this indicator is a more stringent measure of liquidity compared to the current ratio. It excludes inventory from current assets and compares liquid assets to current liabilities. A quick ratio above 1 suggests strong liquidity and financial health.

- Cash Flow from Operations: This indicator tracks the cash generated from a company’s core operating activities. Positive cash flow from operations indicates that the business is generating enough cash to sustain and grow its operations without relying on external financing.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): EBITDA measures a company’s overall financial performance and is used as an alternative to net income. It provides a clearer view of operational profitability by excluding non-operational expenses and non-cash charges.

- Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV): CAC measures the cost of acquiring a new customer, while CLV estimates the total revenue expected from a customer over their lifetime. Balancing these metrics helps assess the efficiency of marketing strategies and long-term profitability.

These indicators offer a comprehensive view of a company’s financial health and operational efficiency, helping professionals make informed strategic decisions and plan for future growth. But thy can be better categorized as in the following paragraph.

Professional’s Financial performance indicators to watch in 2025

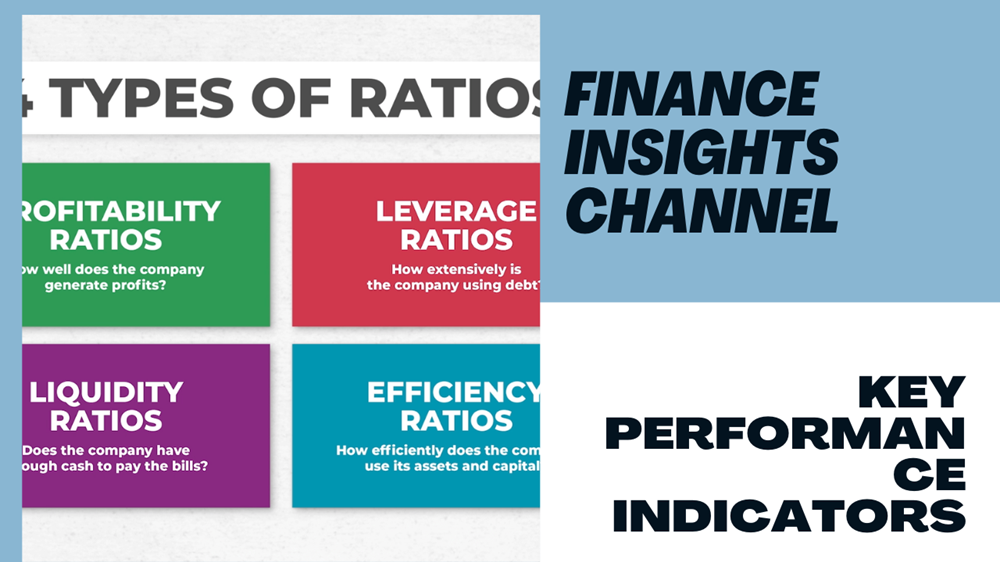

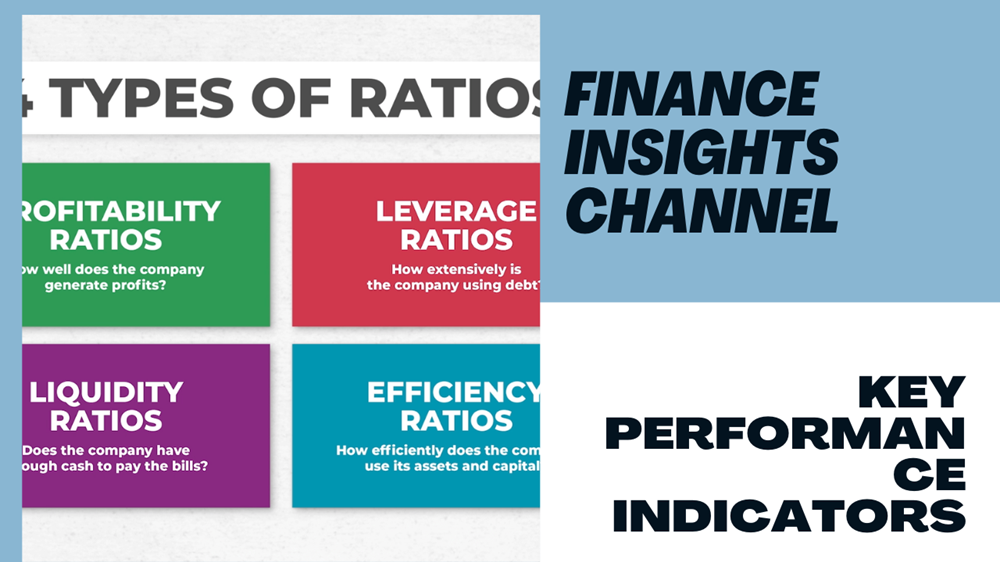

Category of Financial indicators:

As a matter of fact, these can also be classified under Profitability Rations, Leverages Ratios, Liquidity Ratios and efficiency Ratios. So, here’s a detailed classification of the ten financial performance indicators under Profitability Ratios, Leverage Ratios, Liquidity Ratios, and Efficiency Ratios:

Profitability Ratios

- Revenue Growth Rate

- Definition: Measures the percentage increase in revenue over a specified period.

- Significance: Indicates how well a company is expanding its business and capturing market share. Consistent revenue growth is a positive sign of a company’s market performance and future potential.

2. Operating Margin

- Definition: The ratio of operating income to revenue, reflecting how much of each dollar of revenue is retained as operating profit.

- Significance: Shows the efficiency of a company’s core operations. A higher operating margin means better control over operating expenses and higher profitability from core activities.

3. Net Profit Margin – Professional’s Financial performance indicators to watch in 2025

- Definition: The percentage of revenue remaining after all expenses, including taxes and interest, have been deducted.

- Significance: Provides insight into overall profitability and financial health. A higher net profit margin indicates efficient cost management and strong overall profitability.

4. Return on Equity (ROE)

- Definition: Net income divided by shareholders’ equity. It measures how effectively the company is using shareholders’ equity to generate profits.

- Significance: Indicates the effectiveness of management in using equity investments to drive profits. Higher ROE suggests strong financial performance and effective utilization of equity capital.

5. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

- Definition: Measures a company’s overall financial performance by excluding interest, taxes, depreciation, and amortization.

- Significance: Provides insight into operational profitability and cash flow generation from core operations, offering a clearer view of business performance without non-operational influences.

Leverage Ratios:

1. Debt-to-Equity Ratio – Professional’s Financial performance indicators to watch in 2025

- Definition: Compares total debt to shareholders’ equity.

- Significance: Indicates the level of financial leverage and risk. A higher ratio suggests a greater reliance on debt financing, which can lead to higher returns but also increased risk.

Liquidity Ratios – Professional’s Financial performance indicators to watch in 2025

1 Current Ratio

- Definition: The ratio of current assets to current liabilities.

- Significance: Measures a company’s ability to cover short-term obligations with short-term assets. A ratio above 1 indicates sufficient liquidity, while a lower ratio suggests potential liquidity issues.

2. Quick Ratio – Professional’s Financial performance indicators to watch in 2025

- Definition: Also known as the acid-test ratio, it measures the ability to cover short-term liabilities with the most liquid assets, excluding inventory.

- Significance: Provides a stricter assessment of liquidity compared to the current ratio. A quick ratio above 1 indicates strong liquidity, even when inventory is not considered.

Efficiency Ratios

1. Cash Flow from Operations

- Definition: Tracks the cash generated from core operating activities.

- Significance: Reflects a company’s ability to generate sufficient cash flow from operations to sustain and expand its business, indicating operational efficiency and financial health.

2. Customer Acquisition Cost (CAC)

- Definition: Measures the cost associated with acquiring a new customer.

- Significance: Helps assess the efficiency of marketing and sales strategies. Lower CAC indicates more effective customer acquisition efforts.

3. Customer Lifetime Value (CLV) – Professional’s Financial performance indicators to watch in 2025

- Definition: Estimates the total revenue a company can expect from a customer over their entire relationship.

- Significance: Provides insight into the long-term value of customers. A higher CLV relative to CAC suggests that the company is effectively retaining and maximizing revenue from its customer base.

Therefore, by understanding and monitoring these indicators, professionals can gain a comprehensive view of a company’s financial health, operational efficiency, and overall performance, enabling more informed decision-making and strategic planning.

What we offer clients: Professional’s Financial performance indicators to watch in 2025

Cessummit provides a comprehensive suite of services, including accounting, taxation, auditing, corporate registration, compliance certificates, business plan development, company profiles, and business proposals. These offerings make it a valuable partner for businesses seeking professional support in financial management and strategic planning.

For inquiries, you can contact Cessummit at cessummit0518@gmail.com or call 09053130518.

Related Topics to Professional’s Financial performance indicators to watch in 2025

- Setting 2025 business financial goals

- Professional’s Financial goals to watch in 2025

- 2025 personal financial goals setting

- Targeted Financial goals for Professionals to watch in 2024

- Targeted Professional’s Goals to Watch in 2025

- Apply These 2024 Mindsets to Make Money.

- How poverty mentality impacts financial prosperity in 2024

- The Impact of Poverty Mentality on Financial 2024 Decision-Making

- How to Break Poverty Mentality Cycle

- How poverty mentality makes no money

- The Essential principles for making money in 2024/2025

- Essential business financial records

Summing up:

In 2025, professionals looking to gauge financial performance should focus on several key indicators to navigate an evolving market. Revenue growth and profitability remain foundational, but cash flow management and liquidity ratios will offer vital insights into an organization’s operational efficiency. Monitoring return on investment (ROI) and cost-efficiency metrics will help professionals assess long-term sustainability. Additionally, emerging factors such as ESG (Environmental, Social, and Governance) criteria, digital innovation investments, and the ability to adapt to changing regulatory environments will be increasingly crucial. Staying agile and data-driven will be essential to maintaining competitive advantage in the year ahead.